Natural rubber surges, La Niña phenomenon [Ryuji Sato]

Ryuuji Sato Profile

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined Genesis Co., Ltd. (now Oval Next Co., Ltd.), a provider of information on finance and investments, after working at a marketing company. He has written analyst reports on macroeconomic analysis, currency, commodities, and stock markets, and has been involved in trading. In 2010 he founded “H-Square Co., Ltd.”, writing analyst reports and planning/publishing works such as “FOREX NOTE Currency Handbook.” He also serves as a radio host related to investments. An individual trader. A member of the International Federation of Technical Analysts and a Certified Technical Analyst. Main caster on Radio Nippon’s “The Money Onosato’s Market Forecast” (Mondays 15:00–).

Official site:Sato Ryuuji Blog

※This article is a republication/re-editing of an article from FX Strategy.com January 2021 issue. Please note that the market information written in the text may differ from the current market.

Rubber Recovers Sharply from 12-Year Lows

There is a disturbance in the natural rubber market. During the COVID-19 period, rubber prices sank to a 12-year low in April this year, but from summer to autumn, due to a recovery in Chinese demand and weather factors, the market tightened, and prices surged in October.

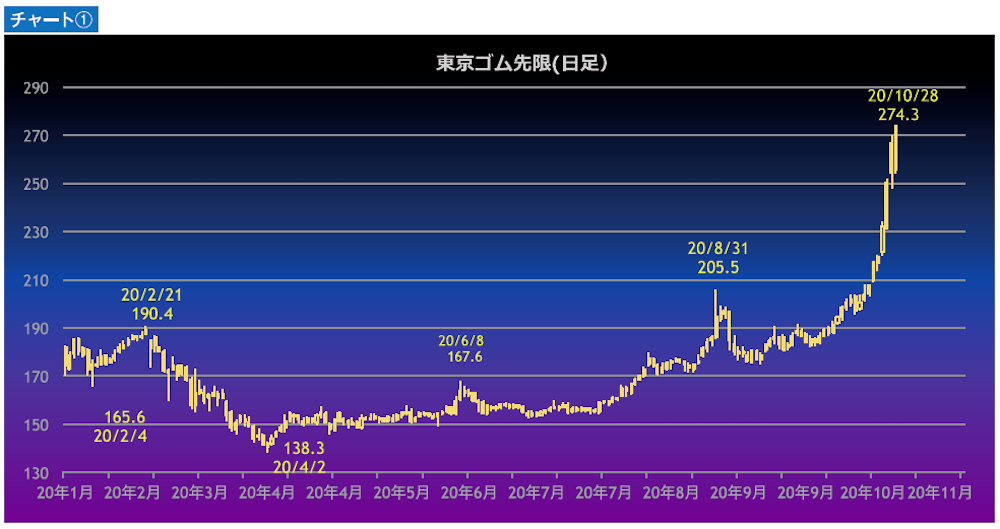

First, let’s briefly review the rubber market since this year’s coronavirus shock while looking at the chart of the RSS3 front-month futures (quoted in yen per kilogram) (see Chart ①). When the novel coronavirus emerged in Wuhan, China, rubber prices began to fall sharply, dropping below the key level of 200 yen on January 21, and by February 4 fell to 165.6 yen. In just 13 trading days from January 17, a drop of over 20% occurred.

On February 21 prices recovered to 190.4 yen, but as the coronavirus spread worldwide, the market then entered a largely one-sided downtrend, and by April 2, prices fell to 138.3 yen, the lowest since March 17, 2009—about 12 years low. A drop of 33.7% in two and a half months. After that, prices hovered around 150–160 yen.