The Market Tide of “Demand and Supply Demon” Tetsuo Inoue: Professional Market Analysis Know-How and Notable Stocks Revealed! | Episode 9

Inoue Tetsuo Profile

Inoue Tetsuo. Representative of Spring Capital, Chartered Member of the Japan Society of Financial Analysts. After graduating from Sophia University, he served as head of the investment department at a domestic insurance company, and then shifted to become Chief Strategist and Head of Japanese Equity Investment at UAM Japan Inc. (now Old Mutual Group). Subsequently he held similar positions at Proud Investment Advisors and MCP Group, an investment management company managing one of the largest fund-of-funds in Asia, before becoming independent. Known as the “demand and supply demon,” he has also served as a personality on Nikkei CNBC TV programs “Night Express” and “~Offensive IR~ Market Breakthrough,” and on Radio NIKKEI’s “Asazai.”

From original technical analysis and demand-supply trends, he analyzes the direction of the stock market (stock indices) from his unique perspective in his newsletter “Market Trends,” and in the video school “Winner’s Screening - Stock Hybrid Battle -” where Mr. Inoue and Mr. Shin Taro Sakamoto (B Komi) provide market commentary and select featured stocks. It is well received on GogoJungle (GogoJungle).

Newsletter:Market Trends

Video School:Winner’s Screening - Stock Hybrid Battle -

*This article is a reprint/edit of FX攻略.com December 2020 issue. The market information described herein may differ from the current market, so please be aware.

Reasons for the September Plunge in U.S. Tech Stocks

The U.S. stock market, which had quietly risen with tech stocks leading the way, began to show a corrective tilt when hearing the “voices of September,” due to profit-taking in tech stocks. I believe the reason lay in Apple and Tesla stock splits and the Dow Jones components reshuffling.

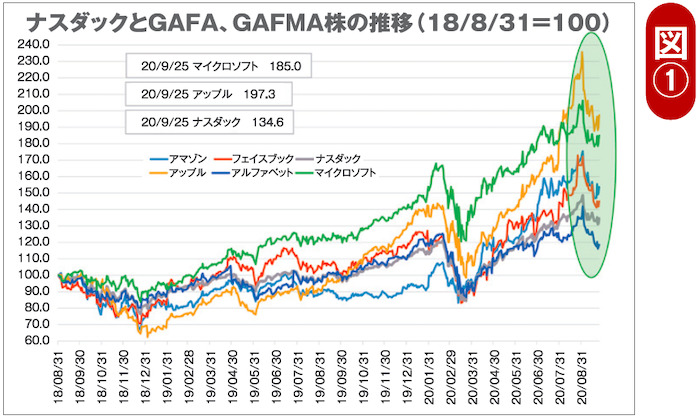

First, Apple split 1-for-4 on August 31, and by September 2 the minimum investment amount had fallen, raising expectations for greater liquidity, leading to a rise in stock price; afterward, there was a large movement of “partial profit-taking” due to increased number of shares. Tesla’s split was 1-for-5, amplifying this effect. Figure 1 shows the transition of the old GAFMA stocks and the Nasdaq, indexed to 100 at the end of August 2018. On the peak date of September 2 of this year, the Nasdaq rose to 148.7 (about 1.5x), while Apple on the same day was 230.9. Also, while not part of GAFMA, Tesla rose to an astonishing 741.5.