Artificial Intelligence, Market Trends, and Computers | Episode 8: Stock Bubble and Plaza Accord [Naoshi Okumura]

Ogura Hisashi Profile

Ogura Hisashi. Graduated from the master's program in the Faculty of Engineering in 1987. The theme is AI (Artificial Intelligence). Developed numerous mathematical models at Nikko Securities. Co-developed investment models with Stanford University professor Dr. William Sharp (Nobel Prize in Economic Sciences in 1990) and achieved world-first online distribution of Tokyo Stock Exchange stock prices. Furthermore, founded a venture company with a Mossad science advisor from Israel, commercialized AI technology, and introduced it to major airports, achieving numerous achievements at the intersection of finance and IT. Currently提供s a model that evaluates analyst ratings using AI ("MRA"), an AI-estimated near-future FX rate ("FXeye"), and a chart analysis that displays risk and return ("Twilight Zone"). To raise financial literacy in Japan, he hosts a Financial Literacy School.

Hobbies include audio and sports. Began aerobic competition 15 years ago, NAC Master Division Single champion 9 consecutive times, 2016 Senior 2nd place, 2014–2016 Japan Championship Chiba Prefecture representative, 2017–2018 Japan Championship Master 3 runner-up. Although he claims to be athletic, in fact he is "tone-deaf" and not good at ball sports. His motto is "No decision is ever too late."

Blog:https://okumura-toushi.com/

*This article is a reprint/reedit of an article from FX攻略.com November 2020 issue. Please note that the market information in the main text may differ from current market conditions.

Japan's Stock Bubble

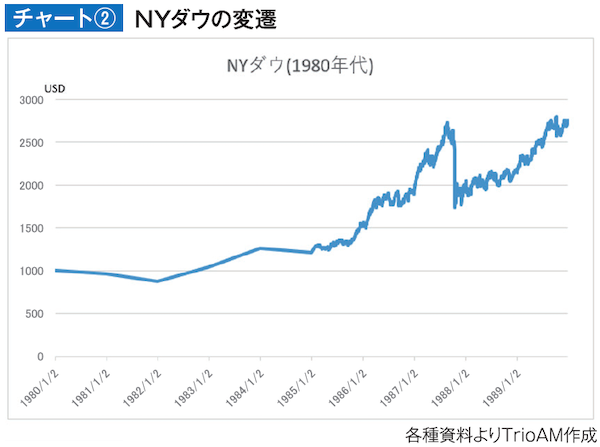

The 1980s market should first and foremost be highlighted as Japan's stock bubble. First, let's look back at the stock markets of Japan and the United States at that time (see Chart ①, ②).

On January 4, 1980, the Nikkei Stock Average was 6,560. At that time, compared with Japan's economic power and corporate competitiveness, stock prices were undervalued, but over the next ten years the price rose steadily to 40,000. At the end of 1989, it was 38,916, meaning it rose 5.93 times in ten years. It was a stock bubble.

In 1985, under the Nakasone administration, the Electrical Communications Bureau was privatized as NTT and listed on the market in February 1987. There was a flood of buying in the market; the issue price was 1,197,000 yen, the first price was 1,600,000 yen, and two months later it rose to 3,180,000 yen. The money made from stocks also flowed into real estate, and land inside the Yamanote Line rose to the extent that the entire United States could be bought.

There is also an anecdote about a famous Japanese golf course where a U.S. female professional golfer asked, "This golf course is nice, I wonder how much it costs?" and was told, "100 million yen," to which she replied, "That's cheap, shall I buy it?" and was startled when told, "No, this is the price of a membership."