[Chart Analysis Feature] The three giants Yamanaka, YENzo, and Hosoda speak at length about technical analysis

In 2020, not only exchange rates but financial markets as a whole—including stocks and commodities—were greatly unsettled by the impact of the novel coronavirus. In today’s unstable market, trading using technical indicators is indispensable for success. This time we invited three people, Mr. Yasushi Yamanaka, Mr. YEN-zou, and Mr. Tetsuo Hosoda, to ask which technical indicators to use and how to study effectively to use them well. This will be helpful not only for beginners but also for those迷っている about technical indicators.

Yasushi Yamanaka’s Profile

Director at Ascendant Co., Ltd. Joined Bank of America in 1982, Vice President in 1989, Proprietary Manager in 1993. In 1999, Assistant Director of the Foreign Exchange Funds Department at Nikko City Trust Bank. In 2002, founded Ascendant Co., Ltd.

Official Blog:Ascendant/Yasushi Yamanaka's FX information distribution site

Twitter:https://twitter.com/yasujiy

YEN-zou’s Profile

For over 20 years, worked as a foreign exchange dealer at US-based Citibank, UK-based Standard Chartered Bank, and other foreign banks. Currently a top professional trader, trading currencies, the Nikkei 225, Nikkei options, and individual stocks. President of ADVANCE Co., Ltd., which primarily distributes investment information.

Newsletter:https://www.gogojungle.co.jp/finance/salons/10520/

Blog:http://blog.livedoor.jp/slalom2007/

Twitter:https://twitter.com/YENZOU

Tetsuo Hosoda’s Profile

CEO of Economic Fluctuation Research Institute. Inherits the will of Ichi-me Zanjin (Ichi-me Kinkousei) and is engaged in spreading the correct use of the Ichimoku Kinko Hyo. Writing the market commentary and charting courses for the Ichimoku Kinko Hyo at Economic Fluctuation Research Institute’s “Ichimoku Kinko Hyo Equilibrium Club” and “Stock Newsletter” newsletter. He is a grandson of Ichi-me Zanjin (Mr. Satoshi Hosoda), the founder of Ichimoku Kinko Hyo.

Salon:Three generations of Ichi-me Zanjin Ichimoku Kinko Hyo Salon

Twitter:https://twitter.com/tessei_hosoda

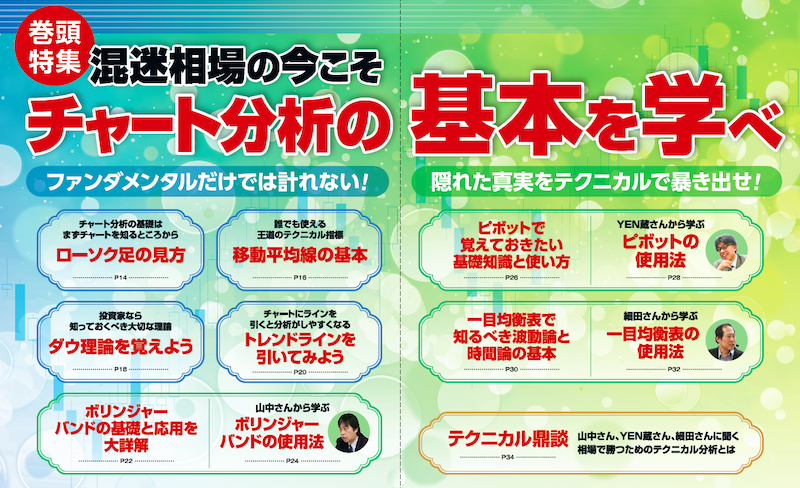

【Feature】Learn the basics of chart analysis during this confusing market

① How to read candlesticks — The basics of chart analysis start with knowing the chart

② The basics of moving averages — The classic technical indicator that anyone can use

③ Learn Dow Theory — An important theory every investor should know

④ Draw trendlines — Drawing lines on the chart makes analysis easier

⑤ The basics and applications of Bollinger Bands in great detail

⑥ Learn how to use Bollinger Bands from Mr. Yamanaka

⑦ Basic knowledge and usage of pivots to remember

⑧ Learn pivot usage from YEN-zou

⑨ Fundamental wave theory and time theory you should know with Ichimoku Kinko Hyo

⑩ Learn how to use Ichimoku Kinko Hyo from Hosoda

<Technical Roundtable> The three giants Yamanaka, YEN-zou, and Hosoda speak at length

※This article is a reprint and revised edition of FX攻略.com’s September 2020 issue. Please note that the market information in the body differs from current market conditions.