The Path of the Foreign Exchange Market from Here Onward, Episode 125 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economic analyst. President and CEO of Arufinantsu. Born in Tokyo in 1964. After graduating from Keio University, he switched careers following his time at the then Mitsubishi UFJ Securities. He analyzes and researches a wide range from finance and the overall economy to strategic corporate management, and even individual asset formation and fund management. He serves as a lecturer for lectures, seminars, and training organized by private companies, financial institutions, newspapers, local governments, and various chambers of commerce and industry, with about 150 lectures per year. He has written numerous serialized articles and comments in print media, including Weekly Gendai’s “Rules of Net Trading” and Examina’s “Moneymantra Master Training Course.” He also writes columns on many websites about stocks, foreign exchange, etc., and is highly regarded as a stock and FX strategist. He also writes for the Home Economy section of the Free Press’s “Fundamental Knowledge of Contemporary Terms.” After regular appearances on TV (TV Asahi “Yajiuma Plus,” BS Asahi “Sunday Online”) and radio (MBS “Sabu-chan’s Asaichi Radio”), he currently serves as a regular commentator on Nikkei CNBC’s “Market Wrap” and Daiwa’s “Market Information TV: Economy Marche.” His main DVDs include “Very Easy to Understand: Tomotaro Tajima’s FX Introduction” and “Very Easy to Understand: Tomotaro Tajima’s FX Practical Technical Analysis.” His main books include “Wealth Review Manual” (Pal Publishing), “FX Chart ‘Profit’ Formula” (Alchemix), “Why Can FX Make You Asset Rich?” (Text) and many others. His latest publication is “How to Make Money Riding the Rising US Economy.”

※This article is a reprint/edit of an article from FX Tactics.com, September 2020 issue. Please note that the market information written in the text may differ from the current market.

Late May onward, AUD/JPY shows textbook-like technical moves

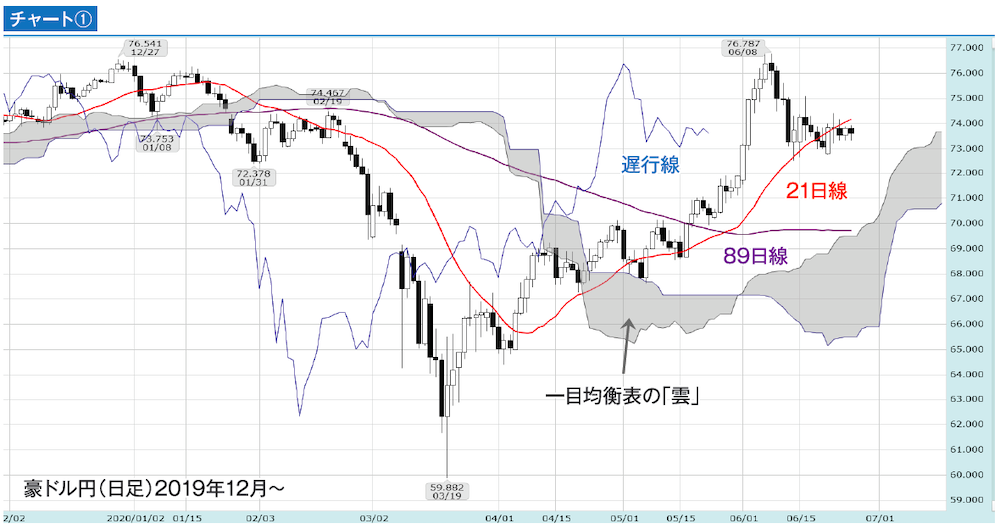

In the previous update, AUD/JPY, which was especially noted in this section, subsequently showed a large upward move for a while. AUD/JPY briefly tested below 60 yen on March 19, but as of the writing time it had retraced as much as 17 yen from the low to its most recent high.

Among these sharp reversals in AUD/JPY, what I want to keep in mind for future reference is that in late May it decisively cleared the 70 yen level, which had been an important milestone, and at the same time the Ichimoku Kinko Hyo daily chart’s lagging line broke above the daily cloud, leading to a strong rise.

Also, around nearly the same time, a Golden Cross formed between the 21-day moving average and the 89-day moving average, and the upward momentum increased from there, which can be said to be a truly “textbook” price movement (see Chart ①).

As a result, in the first week of June, AUD/JPY’s weekly candles rose past the 31-week moving average and the 62-week moving average, and ultimately broke through the weekly cloud, forming a long bullish candle. I remember thinking at the time that this move seemed somewhat over-speedy.