A method to ride breakouts from the box-range market during the Asian and London sessions

Many of you may have felt frustrated after waking up to find that the market had moved a lot…

For Japanese traders, the hours from 22:00 to 06:00 when they are asleep correspond to 13:00–21:00 in New York, which are the times when trading becomes more active.

The “box breakout” method that takes advantage of these active trading periods is a well-known approach, and techniques such as breakouts from the Tokyo session’s highs and lows, and the NY Box Breakout method targeting breakouts from NY session highs and lows are known.

..

Which time frame to define as the box requires verification, but this time we’d like to introduce tools that can semi-automate the box breakout method.

Alert indicators best for validating time-window box breakout

【MT4 Indicator】 Box breakout notifications by alert or email [MTP_BoxBreakOut_Alert]

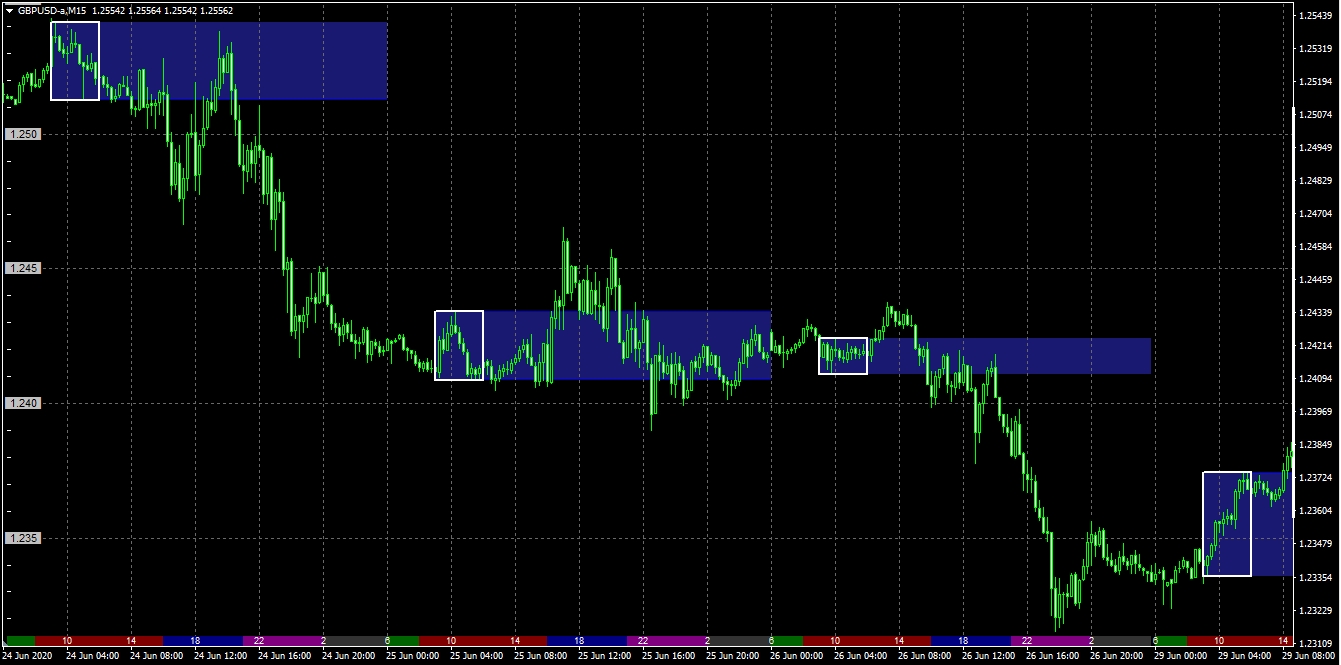

If you set the box to Japan’s morning hours (9:00–12:00)

The box outlined in white corresponds to Japan time 9:00–12:00. Only during the blue-shaded period can you receive alerts or email notifications when you leave the box and when you return.

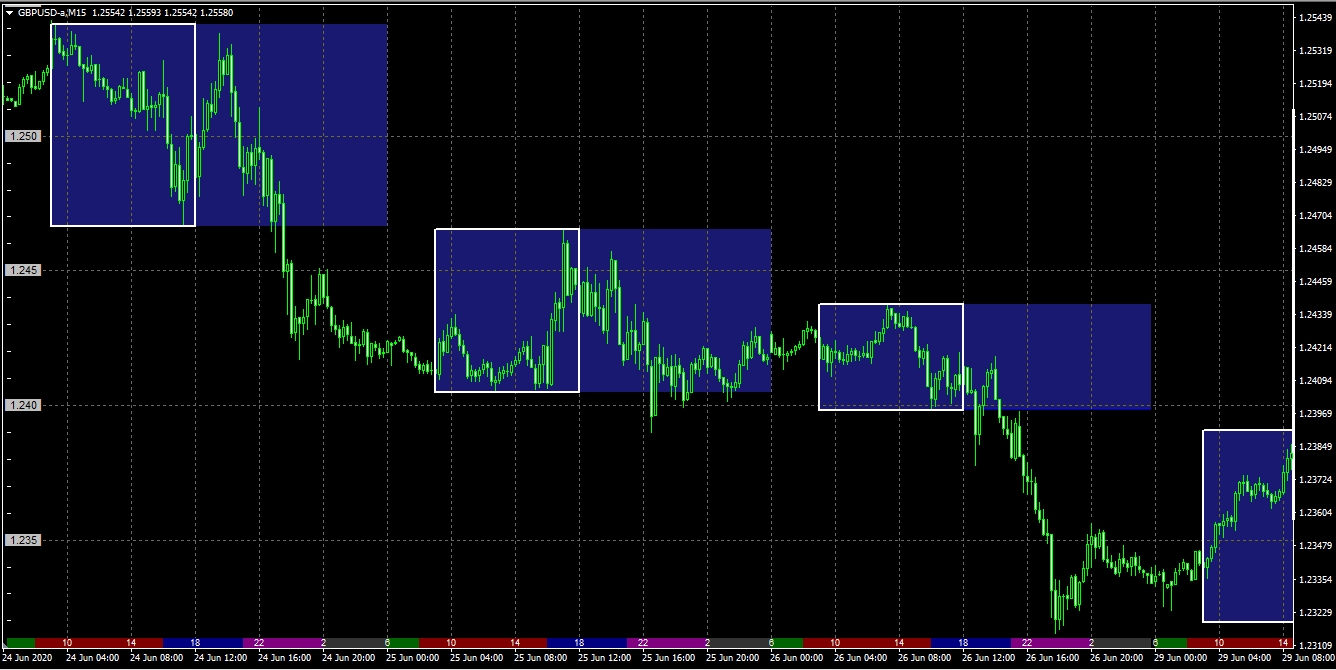

The time window for the box can be changed arbitrarily, and if you designate Japan time 9:00–18:00 as the box,

this is useful when you want to chase only the nightly moves when London and NY participate.

Once the high and low are determined, you can further automate the entry itself by using tools such as a line-entry automation tool.

Related tools:

Line Trading Strategy Tool【LineTrader】

Automatically calculates lot size, profit/loss, risk-reward, etc., and supports one-click order placement

“H_LINE_Z” — Automatically place orders and exit using horizontal lines

A simple design that allows up to three reserved entry lines. Exits are also executed at the designated lines.

ScalTradeAssistPro: A feature-rich MT4 trading assistant tool including auto trailing, line trading, and more

It’s primarily a scalping helper tool, but it’s a high-feature discretionary trading assistant with automatic lot calculation, reverse-position (do-ten) function, trailing, and line-trading features.

Master the Box Breakout Method! A tool with entry-to-exit methods and filtering

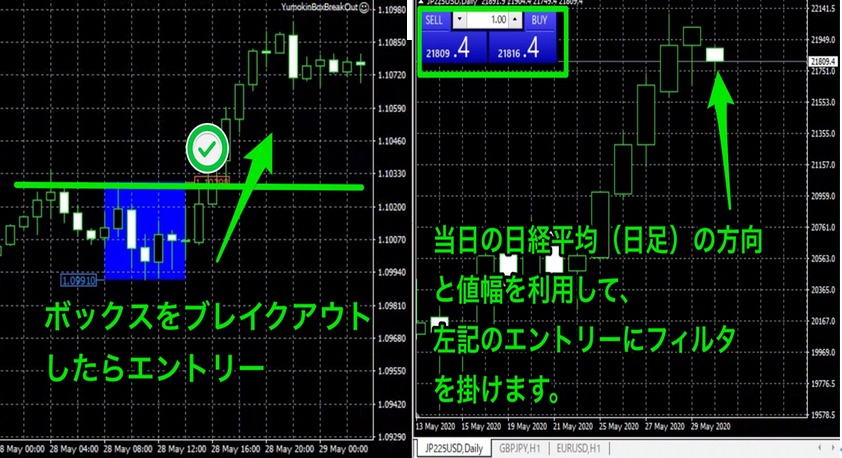

◎ Strategy overview

• Place a stop order in the breakout direction of the box.

• You can filter entries using OsMA and ADX (Entry Pattern 1).

• You can filter entries using the Nikkei 225 index (Entry Pattern 2).

• You can filter entries using Heikin-Ashi candles (Entry Pattern 3).

• Exits are protected by a break-even stop so profits aren’t lost.

• Depending on the box width, it can automatically determine trend-following entries, skipped entries, or counter-trend entries.

• Depending on the candlestick width, it can automatically determine trend-following entries, skipped entries, or counter-trend entries.

• Automatic stop-loss setting is available.

• You can place pyramiding entries to diversify risk.

• Compounding mode is available.

• Pyramid entries are supported.

• Do-ten (reverse) function is supported.

In cases where you slightly exit the box but end up breaking in the opposite direction, you can enable the do-ten feature with a single setting.

Deciding which box time window to use and which currency pair to employ is worth testing.

Because the features are rich and the parameters are complex, we strongly recommend reviewing the manual before purchasing.Manualbefore purchasing.

Box Breakout Order-kun

That’s all for introducing the Box Breakout method and tools that let you trade smartly while you’re sleeping!

Written by Tera GogoJungle Marketing.