The Market Trend of the “Supply and Demand Demon,” Tetsuo Inoue — Professional Market Analysis Know-How and Notable Stocks Revealed! | Episode 5

Inoue Tetsuo Profile

Inoue Tetsuo. Representative of Spring Capital, member of the Certified Members of the Japanese Securities Analysts Association. After graduating from Sophia University, he served as head of the investment department at a domestic insurance company, and then shifted to become Chief Strategist and Head of Japanese Equity Operations at UAM Japan Inc. (now Old Mutual Group). Subsequently, he held similar roles at Proud Investment Advisors and MCP Group, a leading fund-of-funds manager in Asia, before going independent. Known as the “demand-supply demon,” he also serves as a personality on Nikkei CNBC TV’s “Yoru Express” and “The Aggressive IR Market Breakthrough,” and on Radio NIKKEI’s “Asuza i.”

Through original technical analysis and demand-supply trends, Inoue analyzes the direction of the stock market (stock indices) from his unique perspective in his newsletter “Market Tide.” A video school titled “Winner’s Screening - Stock Hybrid Battle -” in which Inoue and B-communication’s Shintaro Sakamoto discuss market trends and pick stocks is now well received on GogoJungle.

Newsletter:Market Tide

Video School:Winner’s Screening - Stock Hybrid Battle -

*This article is a reprint and revision of an article from FX攻略.com August 2020. Please note that the market information written in the main text may differ from the current market.

Europe as the protagonist sold off in April

The Tokyo Stock Exchange released overseas investor regional trends for April. While the Nikkei Average rose by 1,276 yen (6.8%) on a monthly basis, overseas investors as a whole sold ¥488 billion of Japanese stocks. Although this is a reduction from March’s ¥2.359 trillion, it remained a net seller, and it was shocking that Europe, a major “protagonist” among overseas investors, sold ¥308.7 billion.

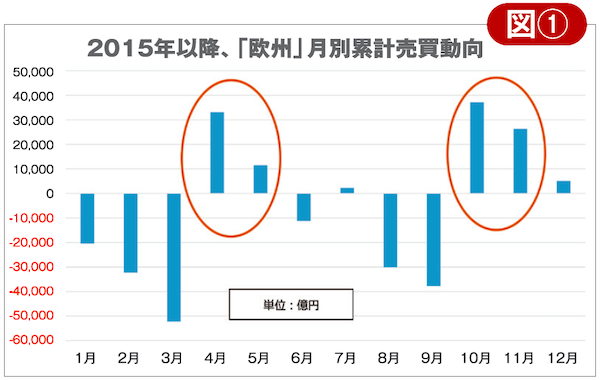

Figure ① shows the cumulative monthly flows for Europe since 2015 when the Shanghai shock occurred (including data through April 2020). It clearly shows purchases in April and October. For April, unlike since 2011, there was net selling for the first time this year.

With the Bank of Japan’s annual ETF purchase quota doubling to ¥12 trillion, the daily impact of purchases reached about ¥200 billion, contributing to index support, and the unwinding of accumulated short positions also boosted the April index rise. However, it is clear that foreigners’ willingness to buy Japanese stocks did not rise.

One reason Europe sold is likely the impact of the previous month’s oil price drop. Since cheap oil strains the finances of oil-exporting countries, funds are pulled back, prompting fund-based selling of world stocks.

Though March-quarter earnings announcements have passed, about 60% of companies are unable to provide earnings projections for fiscal year 2020. This means earnings per share (EPS) cannot be calculated, resulting in important valuation metric PER not functioning. Of course, the same applies to indices. When valuations do not function, technical analysis gains explanatory power for price movements, but we must also properly examine how overseas demand-supply of Japanese stocks existed behind the rise or fall of indices (Contributed May 24, 2020).

Japan’s only monthly FX specialized magazine “FX攻略.com” official site is here