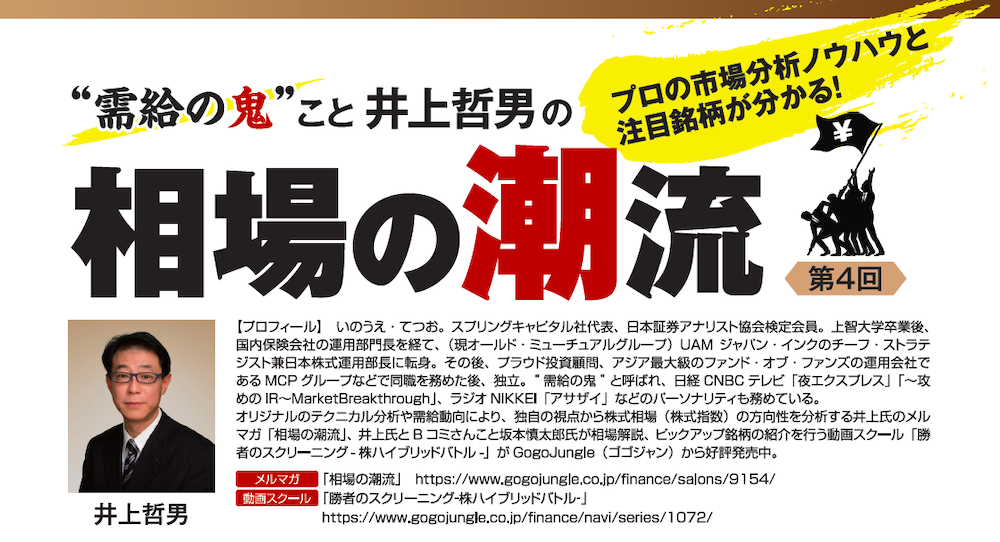

The market trend of the “Supply and Demand Demon” Tetsuo Inoue — professional market analysis know-how and notable stocks revealed! | Episode 4

Inoue Tetsuo Profile

Inoue Tetsuo. Representative of Spring Capital, member of the Japanese Securities Analysis Association. After graduating from Sophia University, he served as head of the investment department at a domestic insurance company, then transitioned to become Chief Strategist and Head of Japanese Equity Investment at UAM Japan Inc. (now Old Mutual Group). Subsequently, at Proud Investment Advisers and MCP Group, which operates one of Asia’s largest funds of funds, he held the same position before striking out on his own. Known as the “demand and supply demon,” he has also served as a commentator on Nippon TV CNBC’s “Night Express” and “IR with an Aggressive Edge — Market Breakthrough,” as well as Radio Nikkei’s “Asuzaij” among others.

Through his original technical analysis and insights into demand and supply trends, Inoue analyzes the direction of the stock market (stock indices) from his unique viewpoint in his newsletter “The Tide of the Market.” His video school “Winner’s Screening – Stock Hybrid Battle –” in which Inoue and Bコミ (Mr. Shintaro Sakamoto) provide market commentary and pick stock recommendations, is popularly sold on GogoJungle (GoGoJungle).

Newsletter:Market Tide

Video School:Winner’s Screening – Stock Hybrid Battle –

※This article is a reprint/edit of an article from FX攻略.com July 2020 issue. Please note that the market information described herein may differ from the current market.

The Implications Included in the Oil Price Drop Are Large

On April 20, WTI crude futures for the May contract closed at an unprecedented negative price of minus 37.63 dollars per barrel, shocking the world. The negative price arose due to storage and inventory constraints.

If you bought WTI but did not close your position with a contrary sale, you would end up taking delivery of crude in Oklahoma. If the price is negative, you would receive the crude and also receive minus 37.63 dollars; however, you cannot just dump the crude into the sea, so storage costs arise, causing prices to soar. In other words, the current crude futures price is calculated by subtracting these costs from the expected crude price.

There were sufficient foreshadowings. According to the U.S. Energy Information Administration (EIA), which releases a weekly petroleum status report —

The official site of FX Magazine “FX攻略.com” in Japan can be found here