New coronavirus and commodity prices [Ryuuji Satou]

Ryuuji Sato Profile

Ryuuji Sato. Born in 1968. After graduating from a US university in 1993, he joined Genesis Inc. (later Oval Next Co., Ltd.), a provider of financial and investment information, after a stint at a marketing company. He has written research reports on macroeconomic analysis, currency, commodities, and stock market, and has been involved in trading. In 2010, he founded H-Square Co., Ltd., writes analyst reports, plans and publishes works such as “FOREX NOTE Foreign Exchange Handbook,” and also serves as a radio program caster related to investments. He is a personal trader. International Federation of Technical Analysts certified technical analyst. Main caster on Radiko Nippon “The Money Ono-sato’s Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Sato Blog

※This article is a republication and re-editing of an article from FX攻略.com July 2020 issue. Please note that the market information written in the main text may differ from the current market.

Gold Chasing Higher

The International Monetary Fund (IMF) revised its world economic outlook on April 14, lowering the 2020 growth forecast to minus 3.0%. Christine Lagarde, Deputy Managing Director, stated at a press conference that the current novel coronavirus disaster could become an economic deterioration of “the worst since the Great Depression,” surpassing the 2009 financial crisis.

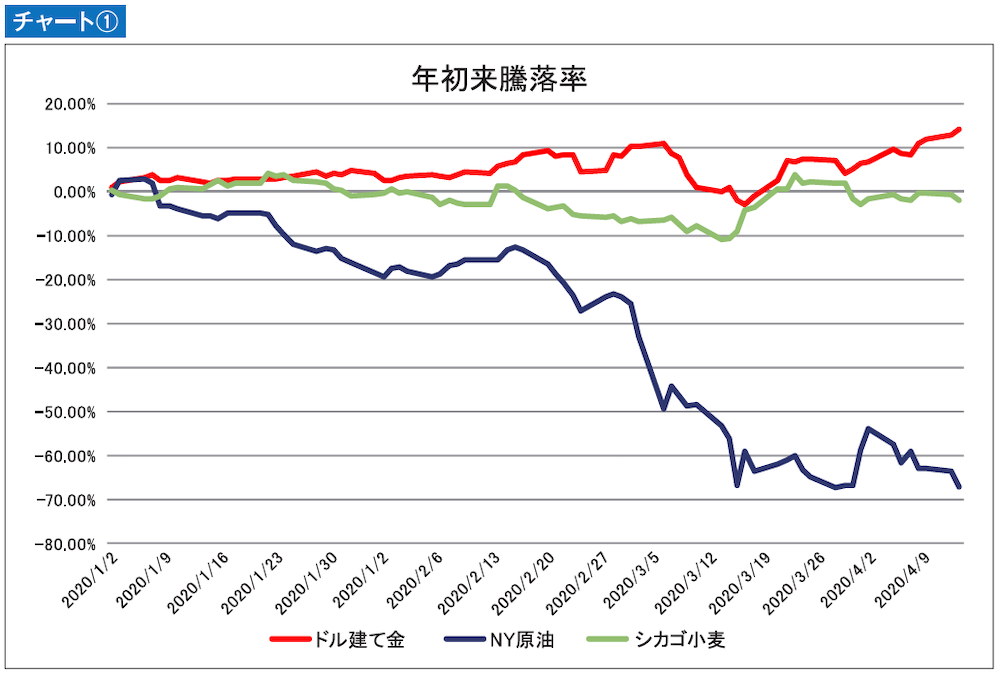

The novel coronavirus is highly likely to trigger a global recession, but responses in commodity markets vary (see Chart 1). Following the previous issue, we will look at how the commodity markets have changed due to the coronavirus.

One of the commodities most affected by the coronavirus is gold. In Japan, Tokyo Commodity Exchange gold futures surged, and during the night trading on April 15, the spot price temporarily reached 5,989 yen per gram, continually marking record highs since the trading began on March 23, 1982. Dollar-denominated gold rose to 1,746 dollars on April 14, marking its high since October 2012. Holdings of SPDR Gold Shares, the world’s largest gold ETF, also surpassed 1,017 tons, highlighting capital inflows into gold.

The official site of FX攻略.com, Japan’s only monthly FX specialty magazine, is here