Invast Securities Sandouchi Kanase resolves instantly! FX Q&A that everyone’s curious about|Episode 3 "What is a Spread?" Part 2 ~ Thinking from Market Liquidity ~

Invast Securities Sandwich Mase

1st-class Financial Planning Technician. He worked in financial product sales at a bank, and later joined Invast Securities as a foreign exchange dealer. Currently, in the Marketing Department, he is engaged in activities to spread the fun of investment to the world. He is reputed as someone who can answer financial questions instantly, and he strives daily to become a big brother figure who can be relied upon by everyone.

Also, he is a sandwich lover to the point where colleagues are often astonished, exclaiming, “You never get tired of them, huh…” He always handles work with a sandwich in hand. Moreover, every day before bed he makes the next day’s sandwich himself, and his romantic side, which he believes to be a charm point, is a misunderstanding.

Twitter:https://twitter.com/sandwich_market

Invast Securities Minori

Starting from scratch with FX AI trading on the official My Mate blog, with live updates in sequence! The goal is to create articles that anyone reading will want to try “Mai Mate.” Minori's AI agent [Hobbs] is also published on the blog!

Mai Mate Official Blog:https://blog.mai-mate.com/

*This article is a reprint/edit of FX攻略.com's June 2020 issue. Please note that the market information written in the text is not the same as the current market.

MinoriLast time you explained the mechanism of rate generation in FX, so why do spreads sometimes widen so much?

MaseIn short, because “market liquidity dries up.” To recap, the rates investors see daily are generated based on rates distributed by banks.

MinoriRight! Does market liquidity involve the banks that provide the rates?

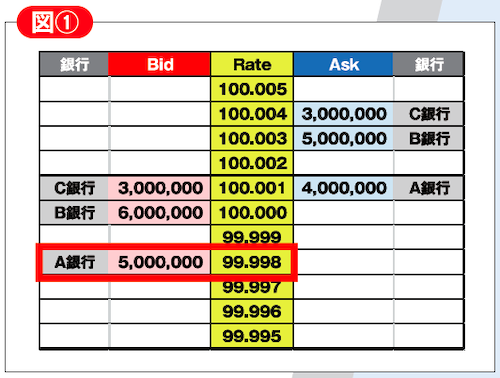

MaseExactly! Bank-distributed rates come with not only the information “USD/JPY will be accepted if the rate is ● yen” but also the condition “transactions up to ● million currency units are allowed.” When you make the distribution rates from banks easier to read, it looks like this (Figure ①).

The Rate in the middle refers to the “rate at which a cover transaction can be conducted” from the FX company’s perspective. Taking Bank A, circled in red, as an example, it means “for up to 5 million currency units, USD/JPY can be sold via cover transaction at 99.998.”

Since the rates and the transaction amounts distributed by each bank differ, the FX company has the discretion to choose which bank to perform the cover transaction with from among them.

The only FX specialty magazine in Japan, “FX攻略.com” official site is here