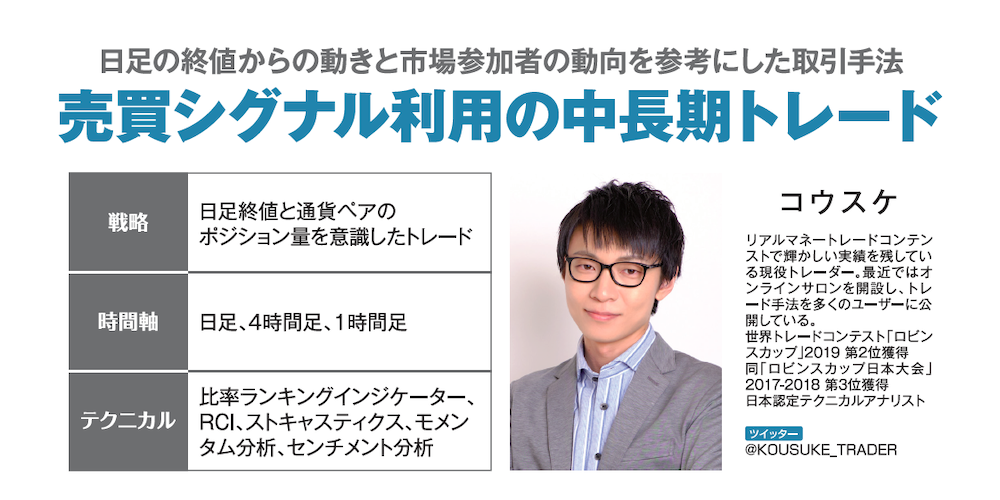

Trading method based on movements from daily closing prices and trends of market participants; medium- to long-term trades using buy/sell signals [Kousuke]

Kousuke's Profile

A current trader who has achieved outstanding results in real-money trading contests. Recently, he opened an online salon and is sharing his trading methods with many users.

World Trade Contest “Robins Cup” 2019 2nd place, same “Robins Cup Japan” 2017-2018 3rd place, Japan Certified Technical Analyst

Twitter:https://twitter.com/KOUSUKE_TRADER

Key Points of the Method

- Strategy: trading with awareness of daily close prices and position sizes of currency pairs

- Trading timeframes: daily, 4-hour, 1-hour

- Technical: Ratio Ranking Indicator, RCI, Stochastics, Momentum Analysis, Sentiment Analysis

New

- Check the Ratio Ranking Indicator to understand currency pair strength/weakness, use the line near the daily close as the median to confirm direction

- When the Ratio Ranking is “Up” and on the 1-hour chart the price temporarily dips near the previous day’s close line and then breaks above the line again, enter a long position

Stop Loss

- Place stop loss around 40–50 pips from the entry point

Take Profit

- Aim for a risk-reward ratio of 1:1 or better, also refer to take-profit lines generated by the custom indicator

Focusing on Market Participants' Behavior and Movements from Close Prices

Professional trader Kousuke introduces a method that emphasizes daily close prices, currency pair position ratios, and supply-demand.

First, from the “Ratio Ranking Indicator,” check whether there is high or low demand for the currency pair and whether long or short positions are dominant. Then predict the daily candlestick formation to determine the trade’s direction. If these two align, there’s a high likelihood of movement in that direction.

In addition, RCI and Stochastics are used to assess market overheating as well.

Since entries are based on two foundations—the chart movement and currency supply/demand—you can achieve more precise trading.

The official site of Japan’s only FX-special magazine “FX攻略.com” can be found here