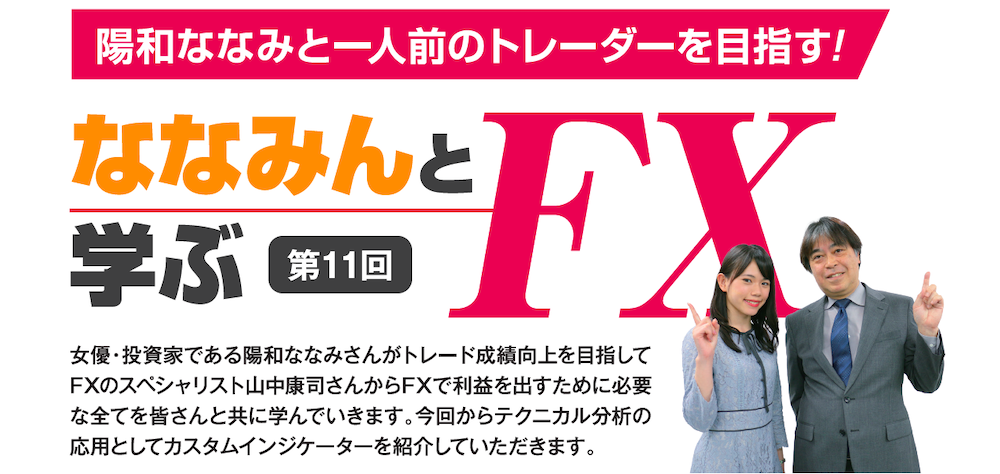

Aim to become a confident trader with Haru Nanami! Learn FX with Nanamin, Episode 11

Actress and investor Nanami Hiwa is learning with all of you what is needed to profit in FX from FX specialist Koji Yamanaka to improve her trading results. Starting with this issue, as an application of technical analysis, he will introduce custom indicators.

※This article is a reprint and revision of an article from FX攻略.com June 2020 issue. Please note that the market information written in the body may differ from the current market.

Click here for the list of serialized articles

【Table of Contents】Aim to become a proper trader with Nanami and learn FX with Nanamin

Koji Yamanaka Profile

Yamanaka Yasujirō. Joined American Bank in 1982, became Vice President in 1989, Proprietary Manager in 1993. Joined Nikko Securities in 1997, served as Deputy General Manager of Foreign Exchange Funds at Nikko City Trust Bank in 1999. Founded Ascendant Co., Ltd. and served as Director in 2002.

Official Blog:Ascendant/Yamanaka Koji provides a currency information distribution site

Twitter:https://twitter.com/yasujiy

Nanami Hiwa Profile

Hiwa Nanami. Formerly Nonaka Nanami, renamed to Hiwa Nanami. Affiliated with Tezuka Koji Office. Active as an actress and investor, appearing in movies, stage, and commercials, and hosting a regular program on Radio Nikkei. Daily trading updates are posted on the blog.

Official Blog:FX Actress Appears! The Serious Real-Time Trading Diary of New Actress Nanamin

Twitter:https://twitter.com/himnas03

Introduction of Recommended Indicators

HiwaThis ongoing series has been teaching FX essentials with Yamanaka-sensei, and from now on we will focus on applied technical indicators with the theme of “Introduction to Custom Indicators.”

YamanakaUntil the previous installments, we have looked at basic technical indicators in sequence. This time maybe a bit more niche, but I’d like to pick out a few useful items you should know and study together. First, “how to use custom indicators,” and then “five convenient custom indicators,” will be explained. I once collected many custom indicators, and my MT4 folder contained about 1,500 of them.

HiwaThat many?!

YamanakaEven 1,500 is only a small part. Technical indicators can be categorized into several types; here we classify them as trend-following, counter-trend, and volume-based. From the trend-following category, I chose “Hull Moving Average” and “MTF Moving Average” for their usability. From the counter-trend category, “Pivot Zone” and “Stochastic RSI,” and from the volume-based category, “Volume Profile.” I plan to introduce these five items across three installments. Nanamin, is there anything you’re particularly interested in among these?

HiwaI’m curious about the MTF Moving Average. Is this something that incorporates multi-timeframe analysis?

YamanakaThat’s right. I’d like to explain that in detail in future posts.