The Outlook of Future Foreign Exchange Markets, Episode 122 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economic analyst. Alfinance president and CEO. Born 1964 in Tokyo. After graduating from Keio University, he transitioned from Mitsubishi UFJ Securities where he worked to pursue a new path. He analyzes and researches a wide range from finance and the economy to strategic corporate management, and ultimately personal asset formation and fund management. He serves as a lecturer for lectures, seminars, and training organized by private companies, financial institutions, newspapers, local governments, and various chamber of commerce groups, with about 150 lectures per year. He has serialized writings and comments in numerous print media, such as Weekly Modern “Rules of Online Trading” and Examina “Money Maestro Training Course,” and has also been highly regarded as a stock and foreign exchange strategist in many other websites. He is also responsible for the Home Economy column in the free magazine Basic Knowledge of Contemporary Terms. After regular appearances on TV (TV Asahi “Yajiu-ma Plus,” BS Asahi “Sunday Online”) and radio (MBS “Megumi’s Asa-chi Radio”), he currently serves as a regular commentator on Nikkei CNBC “Market Wrap” and Daiwa Securities Information TV “Economy Marche.” His notable DVDs include “Very Easy to Understand: Tomotaro Tajima’s FX Introduction” and “Very Easy to Understand: Tomotaro Tajima’s FX Practical Technical Analysis.” His major books include “Wealth Reassessment Manual” (Pal Publishing), “FX Chart ‘Profit’ Equation” (Alchemix), “Why FX Can Make You Asset Rich?” (Texts), among many others. The latest publication is “How to Profit by Riding the Rising US Economy” (Free Press for the People).

*This article is a reprint/edit of an article from FX攻略.com, June 2020 issue. Please note that the market information stated in the text does not reflect current market conditions.

FRB Support Measures That Helped Alleviate Dollar Scarcity

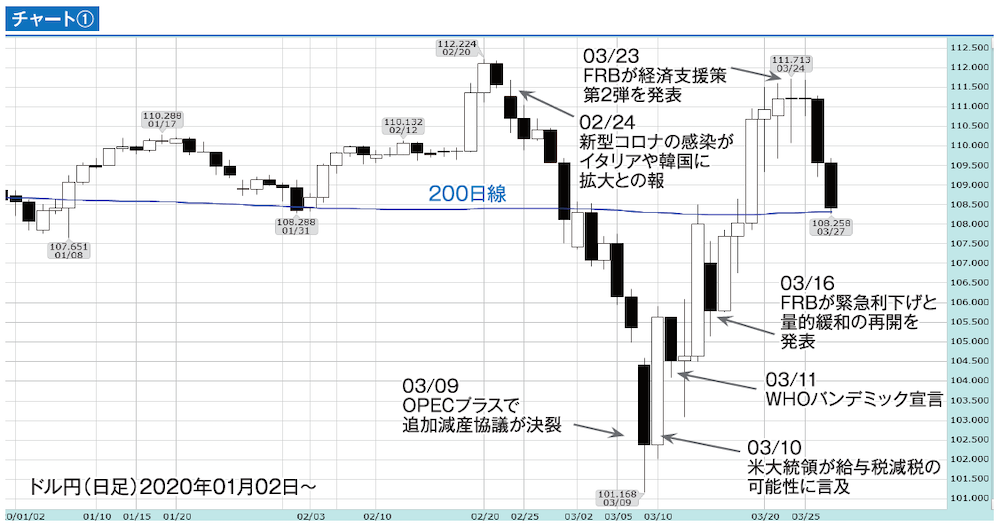

As mentioned in the previous update in this column, the origin of the matter began with the news in late February that the coronavirus had started to spread to Italy, Korea, and other places.

As seen in Chart ①, afterward the USD/JPY briefly fell to the low 101 yen range, but from March 10 it rebounded sharply and returned to around the 112 yen level, approaching that level again.

Incidentally, the plunge on March 9 can be attributed largely to the collapse of additional production-cut negotiations between OPEC members and non-members like Russia, a “temporary shock” and “disappointment at an unexpected outcome.” In fact, after that day the lower bound mostly hovered around the mid-104 yen range.

Nevertheless, the rapid rise from the mid-104s to the upper-111s was striking. As is known, what spread through the market at that time was the concern of “dollar scarcity.” The market was widespread, and money around the world rushed into dollars, driven by the imperative to secure dollar cash above all else.

This was largely influenced by the World Health Organization’s declaration of a pandemic on March 11. Since then, stock prices and crude oil prices around the world fell sharply, triggering enormous margin calls, and the demand for dollar cash surged visibly.

Indeed, in a highly chaotic global situation, even gold, which is typically a safe haven, was forced to be sold off initially due to cash demand in the market.

Looking back, the Fed announced emergency rate cuts and resumed quantitative easing on March 16, in a time that was unusual for its early morning timing in Japan, indicating the urgency of the situation.

However, the market did not feel fully satisfied with the Fed’s emergency measures, and confusion continued for some time. Eventually, the “Second Economic Support Policy” was unveiled on March 23. It stated that the Fed would unlimitedly (as much as needed) purchase US Treasuries and mortgage-backed securities (MBS) guaranteed by government sponsored enterprises (GSEs), and this message did resonate in the market.

In other words, providing as much dollars as needed, so the earlier concerns about dollar scarcity receded rapidly, and dollar-buying demand diminished clearly. As a result, the USD/JPY at the time briefly moved lower toward the 200-day moving average.

Meanwhile, on March 23 and 24, NY gold futures surged by about $176 per troy ounce over two days, another symbolic development.

The official site of FX攻略.com, Japan’s only monthly FX specialty magazine, is here