Forex Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Forecasting the Future of the 3 Major Currencies [This Month's Theme | December to January Price Movement Tendencies and Range, Reading Year-End to New Year T

The year-end and New Year season is a time when the previous trend often pauses, temporarily changes direction, or undergoes significant shifts. Therefore, we will examine the past 10 years of USD/JPY movements from December to January and use that to inform trading around the upcoming year-end and New Year. We will also introduce the currencies that were most vigorous this year, the euro, as well as the British pound aiming for higher price levels at the beginning of the year before Brexit, along with buy/sell strategies.

*This article is a reprint and edit of FX攻略.com January 2018 issue. Please note that the market information written in the text may differ from the current market.

Masakazu Sato Profile

Sato Masakazu. After working at a Japanese bank, he joined Paribas Bank (now BNP Paribas) in France. He served as Interbank Chief Dealer, Head of Funds, Senior Manager, and other roles. He later became Senior Analyst at FX Online, which boasted the highest annual trading volume. He has spent over 20 years in the currency market. He appears on Radio NIKKEI’s “Stock Live Commentary! Stock Chan↑,” Stock Voices’ “Market Wide: Foreign Exchange Information,” and regularly provides market information on Yahoo! Finance.

The USD/JPY, which had been in a flat market, is set to enter a new trend in the year-end and New Year?!

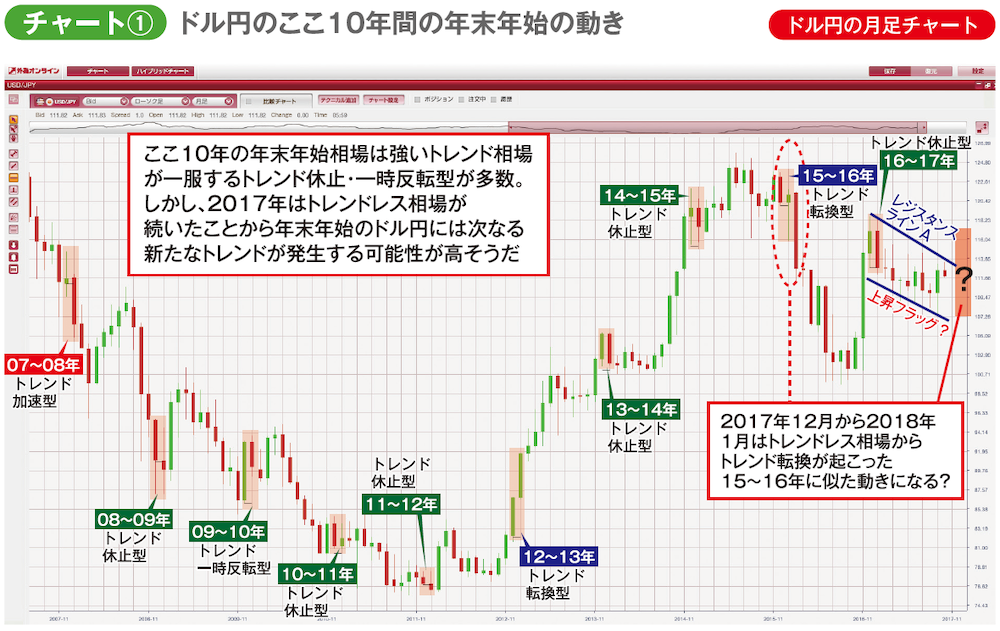

With just over a month left in 2017, year-end and New Year periods are often pivotal for FX markets, so first, let’s take an overview of the USD/JPY price movements from December to January over the past decade.

Chart ① shows the monthly USD/JPY chart from 2007 onward, and the shaded bands indicate the price movements in December and January for each year. We classified each year’s movement into three types: trend acceleration, reversal, and pause (temporary reversal). When a given year had a strong trend, the trend often paused or reversed temporarily around the year-end and New Year. This is likely because trading tends to shrink significantly in late December due to Christmas holidays, making it easier for trends to stall or rebound.

Japan’s only monthly FX specialty magazine “FX攻略.com” official site is here