Foundations and Applications of AI | 3rd Session Deep Learning, Collective Learning, and Reinforcement Learning [Moonlight Forex]

【Profile】

Gekkō Kase (Gekkō Kawase). Active hedge fund trader. Has a track record of consistently earning 200–300 pips per month in FX, and 100–200 million yen in amount-based gains. Currently mainly manages Japanese stocks, and continues FX trading with personal assets. Working under the name Gekkō Kawase without the company’s knowledge, a supporter of individual investors who can glimpse the truth of the market amidst harsh words.

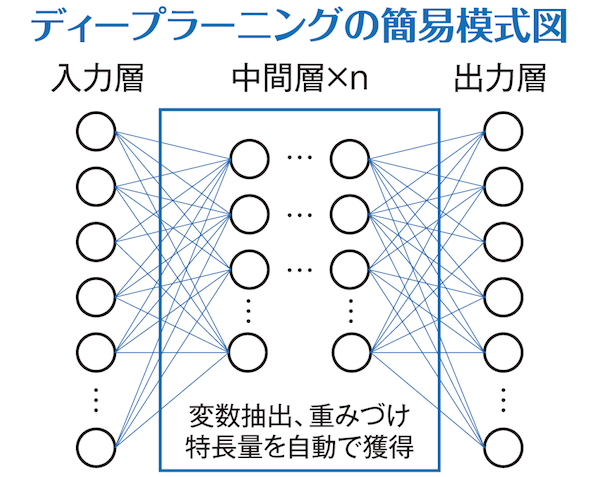

Deep Learning

There is a technique called deep learning, an expanded concept of the neural networks previously explained. A key difference from conventional neural networks is whether the explanatory variables are specified by humans or learned and decided automatically by machines.

In deep learning, the machine extracts variables, assigns weights to them, and repeats the process to yield the optimal results, ultimately identifying the refined variables.

For example, regarding stock prices, there are vast numbers of variables that could influence them, such as a company’s profit levels, valuation, technical indicators, and macroeconomic indicators. In deep learning, these are filtered and selected to ultimately derive the most influential variable. The final variable may be a new variable derived from a combination of several variables.

What’s important here is that the chosen variables are only those that can explain movements during the past learning period; it is not guaranteed that they can explain future movements. Furthermore, for humans to judge this, the original parameters must be recoverable during the modeling process, but deep learning cannot recover them, so deductive inferences cannot be made later. Therefore, it is a very convenient method, but when applying it to operations, some ingenuity is required.

The official site of the only monthly FX specialty magazine in Japan, "FX Special Measures.com" is here