Introduction to European Fundamentals | Episode 8: Fiscal Policy of Eurozone Member States [Miko Matsuzaki]

Miko Matsuzaki Profile

Yoshiko Matsuzaki. Began her trader life at Swiss Bank Tokyo. Went to the UK in 1988, and in 1989 joined Barclays Bank London Main Office Dealing Room. Gave birth in 1991. In 1997 she transferred to Merrill Lynch Investment Bank in London’s City. Later resigned in 2000. Currently, in addition to FX trading, she disseminates Europe-direct information to individual investors in Japan through blogs, seminars, and YouTube. Author of “Miko Matsuzaki’s London FX” and “Always Profitable London FX” (both published by Jiyu Kokumin Sha). Since 2018, she has run the “Fundamentals College.” Also started an online salon on FX manners at DMM.

Blog:http://londonfx.blog102.fc2.com/

Fundamentals College:https://fundamentals-college.com/

Online Salon:https://lounge.dmm.com/detail/1215/

Substantially Transformed Fiscal Policy Surveillance in Europe

We have been focusing on Europe and the UK’s economic and financial policies up to now, so this time I would like to touch on fiscal policy.

Newcomers to FX may not know, but since just after the 2008 global financial crisis, a debt crisis emerged in the Eurozone, and a difficult period continued for about five years. The debt crisis, which started with Greece, hit the low-rated Southern European countries directly, causing a crash in government bond prices and a sharp rise in long-term interest rates. As a result, some euro-area member states abandoned self-managed fiscal operations and survived with aid from the European Union (EU).

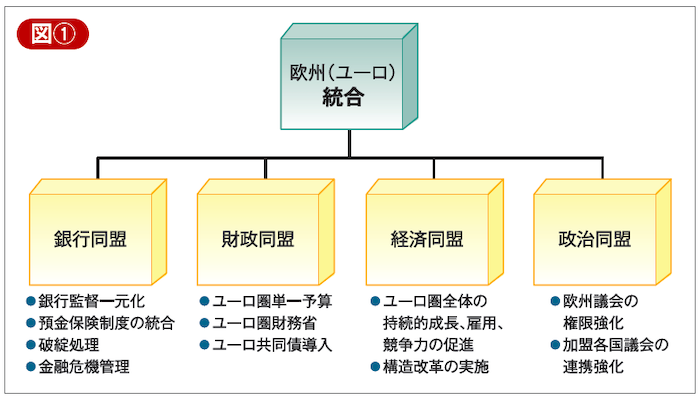

To break this negative chain, at the EU Summit in March 2012, as part of fundamental reform of the euro system, it was agreed to aim to overcome the crisis through deeper integration. To realize this, member states would have to cede part of their national sovereignty and transfer it to the EU. Surprisingly, even though sovereignty was partially ceded, euro member states desired stronger integration, and as a major step toward integration, four pillars were set: a banking union, a fiscal union, an economic union, and a political union (Figure ①).

The official site of Japan’s only FX specialty magazine “FX攻略.com” is here