[Anyone can understand a Buy Signal] Trend following using daily resistance levels: easy day trading for buying on dips / selling on rallies [Max Iwamoto]

Max Iwamoto Profile

As the nickname “Certified Non-Graduate Technical Analyst” suggests, I am a rare no-education analyst in the industry. Even in today’s society where educational background remains prominent, I continue to struggle daily in the FX market, where such factors don’t matter at all. With the belief that now is the time when anyone can start FX easily, I serve as a columnist and seminar instructor, teaching skills to steadily keep winning.

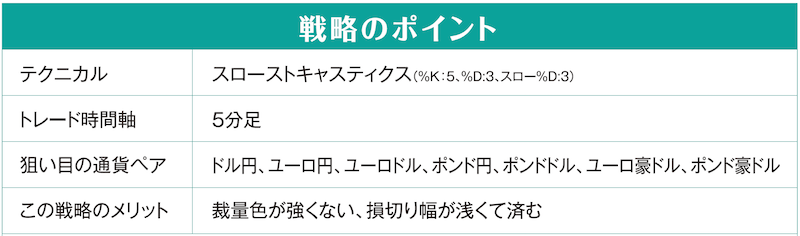

Key Points of the Strategy

Trading Procedures

New

- Draw horizontal lines on the high and low of the past 3 days on the daily chart (use this as resistance) → on the 5-minute chart look for moments where the trend’s pullback reverses at the resistance → enter when a Stochastic signal occurs and a bullish candle forms

Stop Loss

- Set 10 pips beyond the resistance (the 10 pips plus the price range from entry to resistance equals the stop-loss distance)

Take Profit

- Aim for 1.5 to 2 times the stop-loss distance. Either limit order or market order is OK

Note: The “Key Points of the Strategy” and the main text assume a long (buy) in an uptrend. For a short in a downtrend, the rules are the opposite.

A Day-Trade Method That Addresses the Weaknesses of Stochastic

What Max Iwamoto taught is a day-trading method using Slow Stochastic on the 5-minute chart. Stochastic has a tendency for false signals, but to reduce this, use a daily-resistance filter. Specifically, plot the high and low of the most recent 3 days on the chart, and trade only when the 5-minute trend rebounds at those resistance levels. This filter helps compensate for stochastic’s weaknesses.

This method often generates signals during the London and New York sessions, making it ideal for part-time traders who day-trade.

Here is the official site of the only FX-specialty magazine in Japan, "FX Sogyo.com" (FX Strategy.com) official site