[Everyone Can Understand Buying Signal] Trace four timeframes to confirm trading rationale and create a buy/sell scenario with small loss, large profit, and high win rate! [Ryōji Kobayashi]

Profile of Mr. Yoshiharu Kobayashi

He has worked at a major foreign-capital consulting firm, participating in projects around the world, gaining experience behind the scenes in finance such as IPO support, M&A, and the construction of financial systems. Currently, as an investor, consultant, and business owner, he provides consulting targeted at listed companies while also serving as the main lecturer at a school for trading education.

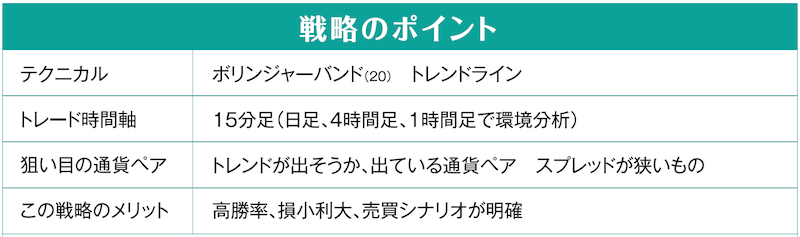

Key Points of the Strategy

Trading Procedures

New

- Look for currency pairs showing a potential or existing trend on the 4-hour chart, confirm the range of movement (take-profit target) → identify the trendlines and horizontal lines that are effective on both the 4-hour and 1-hour charts → enter at the timing of breaking important lines on the 15-minute chart

Stop Loss

- Use the lower line of the Bollinger Bands as a guide (allow within 20 pips)

Take Profit

- Close the position once the take-profit target is reached (do not enter if it would not exceed 20 pips)

*The “Key Points of the Strategy” and the main text assume a long position in a rising market. For a short position in a falling market, the rules are the opposite.

What We Aim For: Trades with Evidence

What Kobayashi-san taught is a method to use Bollinger Bands to analyze the market environment and anticipate entry and exit points. Bollinger Bands make it easy to identify trends based on direction, with the middle line acting as resistance. In phases where momentum builds before a trend, the bands contract (squeeze), and when a trend occurs, the bands expand (expansion).

Specifically, we perform environment checks according to the steps shown in the strategy’s points. To determine the entry timing on the 15-minute chart, we refer to the breakout of the trendlines shared on the 4-hour and 1-hour charts.

Here is the official site of the only FX magazine in Japan, “FX Soguro.com”