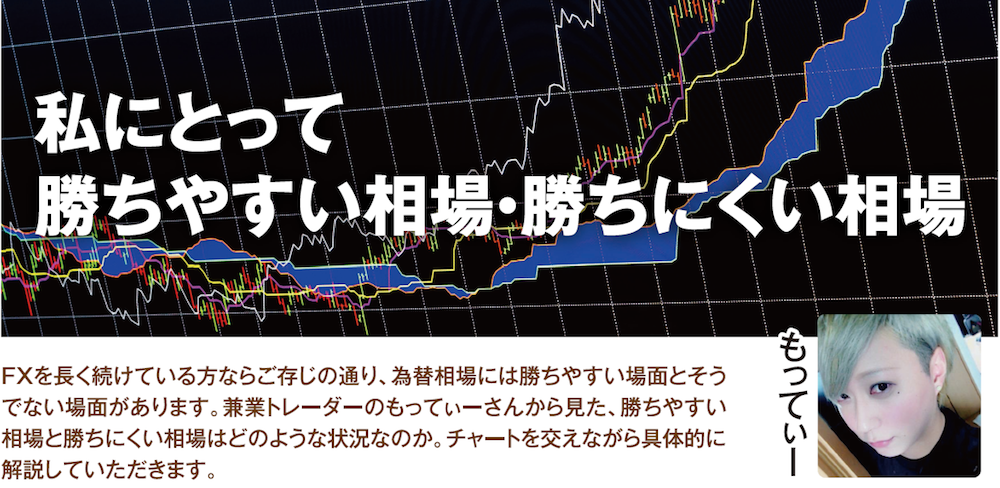

For me, an easy-to-win market / a hard-to-win market [Motti]

As those who have traded FX for a long time know, there are favorable and unfavorable moments in the foreign exchange market. From Motty, a part-time trader, what kinds of market conditions are easy to win and hard to win? We will explain concretely, using charts.

Motty Profile

A full-time trader with 8 years of FX experience. He captures the essence of the market and hones trading skills by riding the trend with the orthodox method. Scalping is his main technique. He actively shares information about trading on Twitter and contributes to improving other traders’ abilities.

Blog:http://motty-fx-trader.com/

Twitter:https://twitter.com/motty_gaytrader

A Easy-to-Win Market Is Based on a Verifiable Trend

For me, a market that is easy to win is a trend. It might sound obvious, but it is not just any trend — it is a “verifiable trend.” A verifiable trend is, for example, a trend that forms on the lower timeframes (1-minute to 5-minute charts) after a pullback from prior highs and lows on higher timeframes, or from key levels. Of course, the higher timeframes also have the trend at that moment, so the image is to confirm the large trend (direction) while trading within the smaller trends inside it.

The official site of Japan’s only FX specialty magazine “FX Sōryaku.com” is here