The market trend of “Supply and Demand Demon” Tetsuo Inoue — professional market analysis know-how and notable stocks revealed! | Episode 1

Tetsuo Inoue Profile

Inoue Tetsuo. President of Spring Capital, member of the Japanese Securities Analysts Association Certification. After graduating from Sophia University, he served as head of the investment department at a domestic insurance company, then transitioned to become Chief Strategist and Head of Japanese Equity Investment at UAM Japan Inc. (part of Old Mutual Group). Subsequently, he held similar roles at Pride Investment Advisors and MCP Group, one of Asia’s largest fund-of-funds fund managers, before becoming independent. Known as the “demand and supply demon,” he has served as a personality on TV programs such as Nippon CNBC’s “Night Express” and “IR with an Aggressive Approach - Market Breakthrough,” and on Radio NIKKEI’s “Asazai,” among others.

From original technical analysis and demand-supply trends, Inoue analyzes the direction of the stock market (stock indices) from his unique perspective in his newsletter “Market Trends,” and in the video school “Winner’s Screening – Stock Hybrid Battle –” where Inoue and Mr. B Comedy, Shintaro Sakamoto, provide market commentary and pick stock recommendations. It is being well received on GoGoJungle (GogoJungle).

Newsletter:Market Trends

Video School:Winner’s Screening – Stock Hybrid Battle –

The situation where US Treasuries remain in focus

From the Tokyo Stock Exchange’s disclosed by-customer trading trends, foreign investor net flows into Japanese equities and futures continued to be net sellers on a weekly average of 246.5 billion yen for the three weeks from the last week of last year to January 17 of this year. Meanwhile, funds continued to flow into U.S.-listed ETFs, indicating that the great rotation out of equities has not ended.

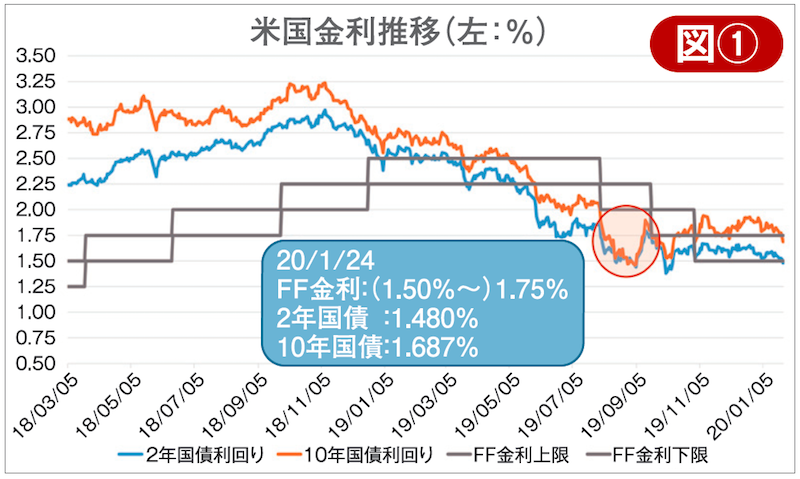

So, what caused this great rotation? It is believed to have been driven by an overzealous rally in U.S. Treasuries (anticipation of rate cuts). Figure 1 shows U.S. policy rates (FF target range) and the yields on 2-year and 10-year Treasuries. Last year’s first half saw clear easing by European and American central banks, which, along with expectations for rate cuts, accelerated the decline in bond yields (prices rose). In the left period of the red circled area, for more than three months, yields of not only the 2-year but also the 10-year were below the lower bound of the FF target rate.