Introduction to European Fundamentals | Episode 7 About the European Central Bank [Mizuki Matsuzaki]

Miko Matsuzaki Profile

Matsuzaki Yoshiko. Began her trading career at Swiss Bank Tokyo Branch. In 1988 she went to the UK, and in 1989 joined the London Dealing Room of Barclays Bank. She gave birth in 1991. In 1997 she transferred to Merrill Lynch Investment Bank in the City of London. She left in 2000. Currently, in addition to FX trading, she conveys Europe-direct information to Japanese individual investors through blogs, seminars, and YouTube. Her publications include “Miko Matsuzaki’s London FX” and “Always Profit London FX” (both from Jiyu Kokumin-sha). Since 2018 she has operated the “Fundamentals College.” She has also started an online salon for FX manners on DMM.

Blog:http://londonfx.blog102.fc2.com/

Fundamentals College:https://fundamentals-college.com/

Online Salon:https://lounge.dmm.com/detail/1215/

Review of the Framework in Monetary Policy

In 2020, the European Central Bank (ECB) will undergo significant changes. One is the framework itself for monetary policy decisions. The other is the lineup of six executive directors.

Following the U.S. Federal Reserve (Fed), the ECB has begun revising the framework for monetary policy decisions. In Lagarde’s final press conference in 2019, she stated that the revision would begin in January 2020 and be completed as much as possible by the end of the year.

Why did both the US and Europe decide to revise at this timing? The ECB last revised in 2003. Since then, globalization and digitalization have changed global circumstances and economic structures.

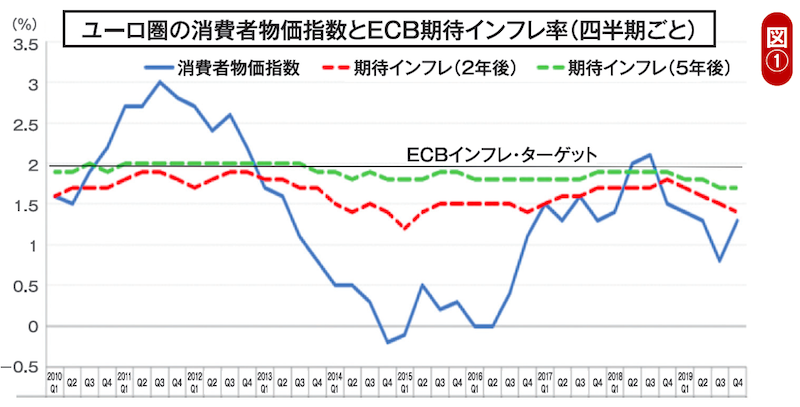

The ECB’s mandate is “maintaining price stability.” The gauge for this is the definition that “the average inflation over the medium term is below 2% but close to 2%.” However, inflation in the euro area and expected inflation have been underperforming for a long time, and no matter how much policy rates are cut, the real interest rate (nominal rate minus expected inflation) does not fall sufficiently (Figure 1). If this continues, what is the point of easing? The same phenomenon has been occurring in Japan for a long time, and to put it bluntly, the ECB’s real motive for the revision may be to avoid “Japanization” at all costs.

Figure 1 Source:ECB Homepage