The Course of Foreign Exchange Markets from Here Onward, Episode 120 [Tomotaro Tajima]

Tomotaro Tajima (Tajima Tomotaro) Profile

Economic Analyst. Alfinants President and CEO. Born in 1964 in Tokyo. After graduating from Keio University, he shifted careers following a stint at Mitsubishi UFJ Securities. He analyzes and researches a wide range from finance and economy in general to strategic corporate management, and even personal wealth formation and asset management. He serves as a lecturer for lectures, seminars, and training organized by private companies, financial institutions, newspapers, local governments, and various商工団体 associations, with about 150 lectures per year. He has numerous serialized writings and comments in print media such as Weekly Gendai “Rules of Net Trading,” and Examinia “FX Master Training Course.” He has written columns on many websites about stocks, forex, etc., and is highly regarded as a stock and foreign exchange strategist. He also writes for the Home Economics section of Gendai Yogo no Kiso Chishiki (Fundamental Knowledge of Contemporary Terms) published by Jiyu Kokuminsha. After regular appearances on TV (TV Asahi “Yaji-uma Plus,” BS Asahi “Sunday Online”) and radio (MBS “Dashing Tsu’s Morning Radio”), he currently serves as a regular commentator for Nikkei CNBC “Market Wrap” and Daiwa Securities Information TV “Economy Marche.” His main DVDs include “Very Easy to Understand: Tomotaro Tajima’s FX Introduction” and “Very Easy to Understand: Tomotaro Tajima’s FX Practical Technical Analysis.” His main books include “Wealth Reevaluation Manual” (Paru Publishing), “FX Chart ‘Profit’ Equation” (Alchemix), and “Why Can FX Make You Wealthy?” (Text) among many others. His latest volume is “How to Make Money Riding America’s Rising Economy” (Jiyu Kokuminsha).

Euro Falls and Dollar Purchases Amid New Virus Outbreak

At the time of writing, the market is dominated by news about the novel coronavirus. As reports of the spread of the virus emerge, the risk-off mood intensifies across the board, and major global stock indices, led by the U.S. and Japan, fall sharply.

Of course, when the USD/JPY breaks lower rapidly, the Japanese stock market tends to react strongly as well; for example, on January 27 the Nikkei Stock Average fell more than 500 points at one point, which is thought to be largely due to a gap down in the USD/JPY during Asia-Pacific trading before the market open.

Nevertheless, it is also true that the lower bound of USD/JPY seems somewhat limited. This is not because one is optimistic about the spread of the virus, but because risk-off behavior strengthens both yen buying and dollar buying simultaneously. Additionally, because Europe’s economy is deeply intertwined with China and concerns about the virus’s impact are significant, there is selling pressure on the euro, which can make the dollar relatively stronger as a result.

In fact, at the time of writing, the “Dollar Index” had already turned up from its year-end lows and remained elevated even as news of the virus spread arrived. At the time of writing, the EUR/USD was again hovering around the 1.1000 level, and if it breaks below this level, the downward momentum is likely to accelerate.

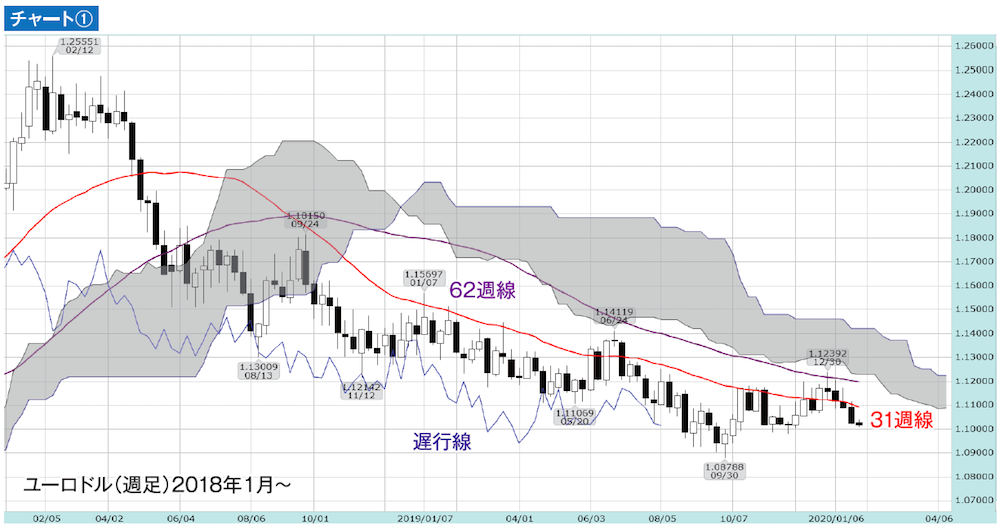

As seen in Chart ①, EUR/USD is currently meeting resistance from the 31-week moving average and the 62-week moving average, and is also under pressure from the weekly Ichimoku Cloud. Moreover, the weekly “lagging line” has not been able to rise above the weekly candlestick from 26 weeks ago, making it difficult to extend upside room easily.

Of course, the main culprit capping Euro upside is the lack of substantial improvement in the Euro area’s economic outlook, which is self-evident.