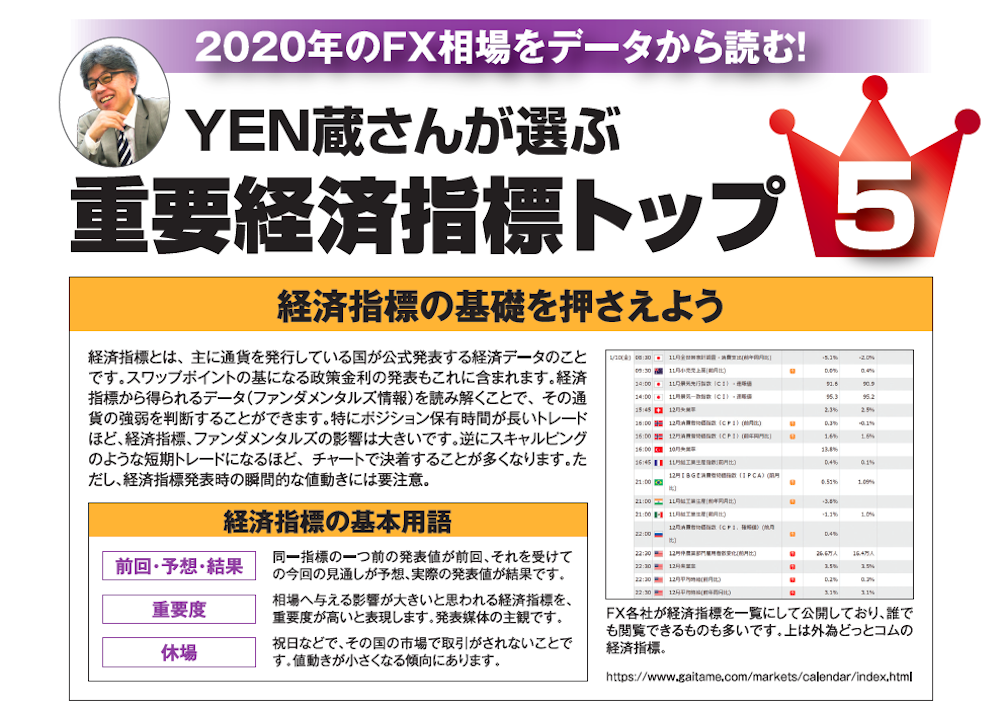

FX Basics & Fundamentals & Technical Ranking [1] Reading the FX Market of 2020 from Data! YENKura picks the Top 5 Important Economic Indicators

In FX, market analysis is essential, but many beginners worry about questions like "Are fundamentals necessary?" and "Which technicals should I use?" This time, we had two professionals rank fundamentals and technicals for you! I think it will be useful not only for beginners but also for people who are already trading in the market.

We have also summarized the basics for those considering an FX debut. Read this to shortcut your way to becoming an advanced trader!

【1】Revisit the basics of FX before learning fundamentals and technicals

【2】YENKura's top 5 important economic indicators

【3】Yasukazu Yamanaka's top 5 important technical indicators

※This page corresponds to article 【2】. Articles 【1】 and 【3】 are separate articles.

YENKura’s Profile

CEO of ADVANCE Co., Ltd. Over 20 years as an FX dealer at a foreign bank. Deep knowledge not only of major currencies but also of dealing in emerging currencies including Asian currencies. Also has strong connections with overseas traders and fund personnel.

First, chase this set of indicators

Looking at pages that compile economic indicators by FX companies, you can see that many announcements come from various countries every day. It is difficult to chase them all, so YENKura picked five especially important ones for you.

The selection criterion is speed. Because human judgment has been quantified, the focus is on soft data that are released quickly.

First, focus on these five types of economic indicators and follow the numerical changes. Even if you are not used to it at first, by continuing to read, you will surely become a trader strong in economic indicators.

In particular, long-running powerful trends such as the Lehman shock or Abenomics are often driven by fundamentals, so it is crucial to be able to read economic indicators.

Ranking criteria: Speed of information

In this ranking, we prioritize indicators that quickly reflect economic moves. Among indicators there are soft data and hard data. Soft data are survey-type indicators and reflect the economic situation the fastest, with PMI being a prime example of especial note. The Bank of Japan’s Short-Term Economic Survey is also soft data and thus noteworthy, but it is released quarterly, so its timeliness is somewhat inferior. Also, we highlight the U.S. employment statistics as a representative hard data indicator.