If you make a profit from cryptocurrency (virtual currency) trading, do you need to file a tax return? Tax accountant explains the latest tax system

Hori Ryuuichi Profile

Nihon FX Accounting Co., Ltd. The only FX-specialized accounting firm in Japan. Word-of-mouth recommendations for tax reduction and tax audit measures have spread, and in addition to client records from Hokkaido to Okinawa, they also handle tax advisory for famous investors. With a motto of not engaging in any aggressive solicitation, they offer free consultations by phone or email, and also provide a free simulation service to see how much tax can be saved compared to now.

Official site:Nihon FX Accounting Co., Ltd.

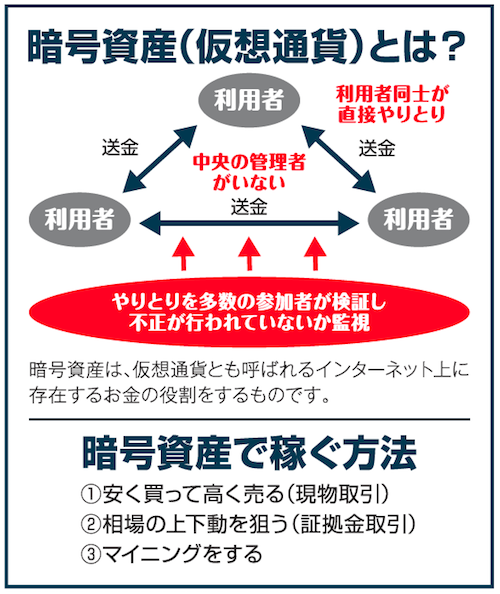

Profits or losses from cryptocurrency trading are, in principle, categorized as “miscellaneous income,” which is taxed together with other income such as salary (employment income). This is called comprehensive taxation, and income subject to comprehensive taxation is taxed at rates ranging from 5% to 45% depending on the amount (resident tax is a flat 10%). There is no flat 20% tax rate as with FX (using a domestic securities company), futures, or Nikkei 225 mini.

Also, when cryptocurrency trading yields a profit, taxes are calculated by combining it with other income as described above under miscellaneous income; however, losses cannot be offset against other income outside miscellaneous income that is taxed separately, and cannot be carried forward to future years.

Specifically, when you incur losses in cryptocurrency, even within the same miscellaneous income category, profits from FX (using a domestic securities company), futures, or Nikkei 225 mini are taxed separately, so they cannot be offset against those gains, nor can they be offset against other income such as salary (employment income) that is not miscellaneous income.