Naniwa's Chart Doctor, Masao Jindo's Mid-Range Wave Strategy Method! | Episode 6 Understanding the Pennant Part ② [Masao Jindo]

Many people are attractaed by high-profit trend markets, but perhaps there are also those who show no interest in situations without trends. To profit fully from trends, you need to master the phase known as the intermediate wave, where a trend has not yet formed. Here, Masao Shindo will teach us how to master such intermediate waves.

※ The "intermediate wave" used in this series is in no way related to the intermediate wave in the Ichimoku Kinko Hyo.

Masao Shindo Profile

Shindou Masao. He is active as a strategist and technical analyst under the leadership of Kojiro Tezuka, the representative of Tezuka Koji Office Co., Ltd. He posts various chart analysis ideas on TradingView.

Twitter:https://twitter.com/masao_shindo

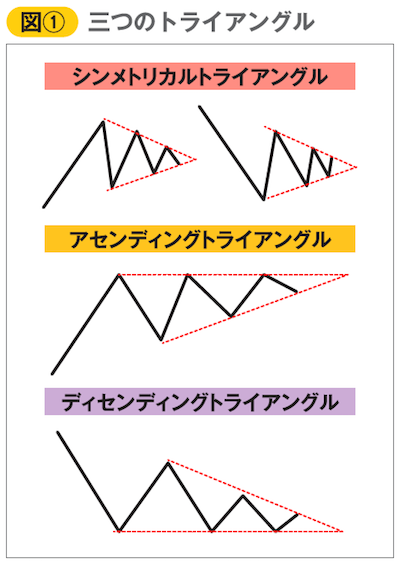

Three Triangles Derived from the Pennant

Hello everyone. Last time we explained about the “pennant.” By understanding pennants that take the shape of triangles, you can learn the basic form of intermediate waves. If prices moved in a perfectly straight line as if a line had been drawn, anyone could trade easily, but unfortunately the market moves in a series of complex waves that form trends. By carefully unraveling this complex and difficult movement piece by piece, you can reliably aim for trend markets. Understanding intermediate waves is important to aim for trend markets, and by mastering intermediate waves you will be able to target trend markets confidently.

This time, let's learn three triangles derived from pennants (Figure 1). As I have said each time, you must not only memorize the chart patterns and shapes; it is essential to understand the meaning implied by those shapes, which will allow you to apply them. Compare the differences of each chart and understand why they occur.