My household money literacy: Let’s try investing too; it’ll be a spice of life [Kasumi Kate]

Kasumi Kate's Profile

Foreign exchange journalist. After studying at a university in California, USA, she worked in Vanuatu, Bahrain, and London before returning to Japan. She worked in sales to financial corporations for Japanese and Asian stocks at a foreign securities company, and in marketing to financial corporations for alternative investments at a British-based investment advisory firm. After retirement, she shifted from the world of stocks to FX-related activities, writing for currency information sites and money magazines, appearing on radio programs, and serving as a lecturer at seminars. Her books include “Foreign Currency Investment Techniques to Multiply Your Money Tenfold” (Forest Publishing) and “FX: Rules for Victory Revealed by Five Investors Who Start Today” (Subaruya).

Money Matters Are a Taboo

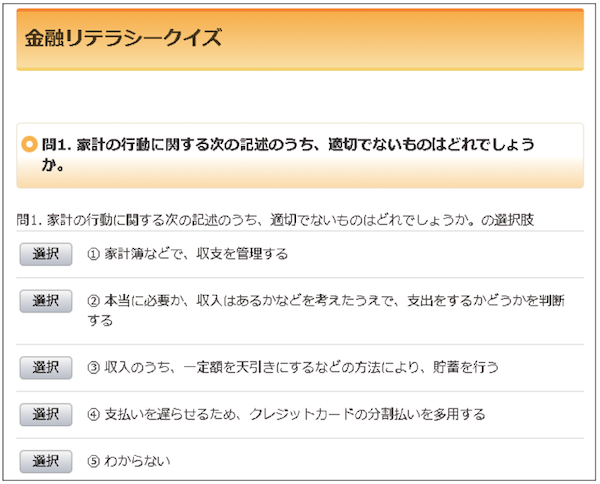

While preparing this manuscript, I tried a five-question quiz from the Financial Services Public Relations Center’s “Financial Literacy Survey 2016.” The result was… I got all questions correct, so I’m a little relieved.

If you ask whether I’m knowledgeable about money, I’d rate myself a notch above average. It was probably always low. My line of work made me become so through external circumstances. I grew up in a family where money education wasn’t taught at all. Whether it was the era, being in a rural area, or the family environment, there are various reasons, I think.

In our family, talking about money or making money was likely considered embarrassing or vulgar. Money earned through hard work was saved at the post office or bank. Money should be managed so as not to waste it. This was our family’s money literacy. Saving and avoiding waste were probably part of risk management.