Current active currency traders will answer anything! Everyone’s Q&A [Traders Securities Everyone’s FX Iguchi Yoshio]

There is no one to challenge doubts, and even researching doesn’t clarify things well... If you have such concerns, leave it to this project. Mr. Iguchi from Treiders Securities will solve your questions!

Yoshio Iguchi Profile

Iguchi, Yoshio. Trading Department, Market Division, Treiders Securities. Certified Technical Analyst. He has been with financial institutions since 1998, mainly engaged in cover-dealing operations centered on commodity markets such as precious metals and oil products. Since 2009, he has been with Minna no FX, conducting dealing activities focusing on USD/JPY and major European currencies. He is skilled in fundamental-based FX analysis and has a strong reputation for short-term forecasts using technical methods. Recently, he has appeared in Minna no FX’s free online seminars, earning praise for clear and understandable lectures. Moreover, on Twitter, professional dealers share real-time opinions on the market, so it’s worth checking.

Twitter:https://twitter.com/yoshi_igu

Q18. Since markets tend to move at opening times, I try to target those moments. Please share any market-specific characteristics or advice. (Fukui Prefecture / 30s / Female)

A. Opening times for each market are prime targets. The common factor is that trends tend to emerge when the market opens. Tokyo, London, and New York each have their own characteristics, so let’s take a look.

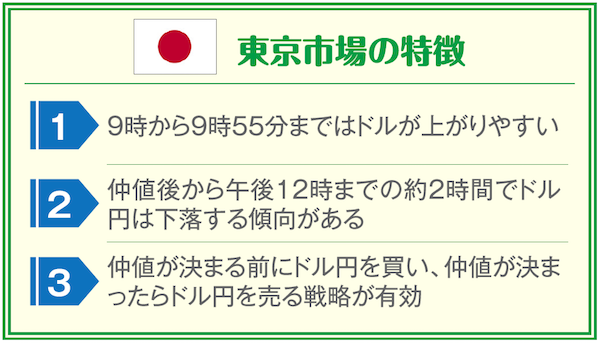

Tokyo Market: Master the Noon Value

In the Tokyo market, the key moment is 9:55 a.m., when the “noon value” for Tokyo time is determined from the opening of the Nikkei. The noon value is the reference rate at which banks exchange foreign currencies with exporters and importers, and the moment it is set is 9:55.

From exporters and importers, orders gather toward the 9:55 noon value, and generally importers (dollar buyers) are more numerous. Banks that anticipate more dollar buying aim to sell to customers at higher rates (encourage them to buy), buying as much dollars before 9:55 to push prices up. Therefore, from around 9:00 to 9:55, the dollar tends to rise.

So what happens after the noon value? Looking at several years of price movements, there is interesting data. From 9:55 a.m. after the noon value to around 12:00 p.m., the USD/JPY falls by more than about 1,000 pips. This is thought to be the dollar’s autonomous retracement after peaking.

If you were to sell USD/JPY daily after the noon value and settle two hours later, it would have yielded enormous profits. Of course, not every day goes as planned, but the basic rule—buy USD/JPY before the noon value is set, then sell after it is set—should be kept in mind.