Harmonic + Price Action Backtesting Verification

I am using this serial publication space to announce a new product related to harmonic patterns.

We have started selling an indicator that displays the planned lines before harmonic detection.

Thank you very much for your great feedback ^^

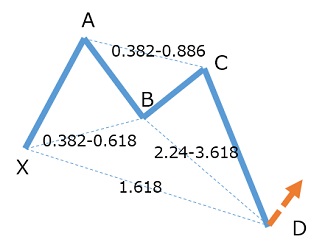

Display harmonic appearance locations in advance

Pre-Harmonic Display Indicator

This is intended to complement the harmonic pattern detection indicator.

Please note that it does not retain alert functionality or display detected harmonics.

Harmonic pattern detection and display require a separate indicator.

The indicators we sell are here. A trial version is also available. Please see the page below for details

Automatic detection of harmonic patterns in MT4!

Harmonic Pattern Detection Indicator

We conducted backtests on harmonic patterns and harmonic plus price action.

Here are the results.

To simplify the effects, we used an extremely simple position strategy.

■ Harmonic only

When a harmonic appears, we cut the position with a ±50 pips limit.

If a harmonic in the opposite direction appears, close all positions and re-enter.

| Currency pair | EURUSD (Euro vs US Dollar) | ||||

| Period | 1 hour (H1) 2013.01.02 09:00 - 2016.12.29 23:00 (2013.01.01 - 2016.12.30) | ||||

| Model | All ticks (the most accurate method using the smallest available time frame) | ||||

| Parameters | Sep00=""; MagicNumber=86290001; IsCountdong=false; SpreadFilter=5; Lot=0.1; Slippage=1; MaxPosition=10; Comment="Gewinn9"; Sep01=""; MaxProfit=50; StopLoss=50; MaxOpenBars=240; IsTrailing=false; TrailingStartPips=100; TrailingPips=50; IsBreakEven=false; BreakPips=20; UnRepeatPosition=4; Sep10=""; OpenHarmonicType=-1; LowHighBars=4; | ||||

| Test bars | 25750 | Model ticks | 71993250 | Modeling quality | 90.00% |

| Discrepancy chart error | 0 | ||||

| Initial margin | 10000.00 | Spread | 20 | ||

| Net profit | -212.83 | Total profit | 13579.86 | Total loss | -13792.69 |

| Profit factor | 0.98 | Expectancy | -0.37 | ||

| Absolute drawdown | 1275.12 | Maximum drawdown | 1448.05 (14.23%) | Relative drawdown | 14.23% (1448.05) |

| Total trades | 568 | Short positions (win rate %) | 285 (53.68%) | Long positions (win rate %) | 283 (49.82%) |

| Win rate (%) | 294 (51.76%) | Loss rate (%) | 274 (48.24%) | ||

| Maximum | Winning trades | 51.24 | Losing trades | -56.69 | |

| Average | Winning trades | 46.19 | Losing trades | -50.34 | |

| Maximum | Winning streak (amount) | 9 (386.93) | Losing streak (amount) | 9 (-449.07) | |

| Maximum | Winning streak (trade count) | 386.93 (9) | Losing streak (trade count) | -449.07 (9) | |

| Average | Winning streak | 3 | Losing streak | 2 | |

■ Harmonic + Price Action

If price action occurs within 48 hours after a harmonic appears, we take a position.

Price action is filtered only by moves of four times the ATR.

The ±50 pips condition is the same.

| Currency pair | EURUSD (Euro vs US Dollar) | ||||

| Period | 1 hour (H1) 2013.01.02 09:00 - 2016.12.29 23:00 (2013.01.01 - 2016.12.30) | ||||

| Model | All ticks (the most accurate method using the smallest available time frame) | ||||

| Parameters | Sep00=""; MagicNumber=86290001; IsCountdong=false; SpreadFilter=5; Lot=0.1; Slippage=1; MaxPosition=10; Comment="Gewinn9"; Sep01=""; MaxProfit=50; StopLoss=50; MaxOpenBars=240; IsTrailing=false; TrailingStartPips=100; TrailingPips=50; IsBreakEven=false; BreakPips=20; UnRepeatPosition=4; Sep10=""; OpenHarmonicType=-1; LowHighBars=4; | ||||

| Test bars | 25750 | Model ticks | 71993250 | Modeling quality | 90.00% |

| Discrepancy chart error | 0 | ||||

| Initial margin | 10000.00 | Spread | 20 | ||

| Net profit | 890.68 | Total profit | 3922.99 | Total loss | -3032.30 |

| Profit factor | 1.29 | Expectancy | 6.10 | ||

| Absolute drawdown | 218.13 | Maximum drawdown | 292.73 (2.71%) | Relative drawdown | 2.71% (292.73) |

| Total trades | 146 | Short positions (win rate %) | 73 (60.27%) | Long positions (win rate %) | 73 (56.16%) |

| Win rate (%) | 85 (58.22%) | Loss rate (%) | 61 (41.78%) | ||

| Maximum | Winning trades | 51.24 | Losing trades | -57.80 | |

| Average | Winning trades | 46.15 | Losing trades | -49.71 | |

| Maximum | Winning streak (amount) | 7 (336.67) | Losing streak (amount) | 3 (-156.69) | |

| Maximum | Winning streak (trade count) | 336.67 (7) | Losing streak (trade count) | -156.69 (6) | |

| Average | Winning streak | 2 | Losing streak | 2 | |

This has the effect of increasing the win rate.

The number of trades is about one third, isn’t it?

However, the graph shows a rising right tail, suggesting the effect may be real.

Regarding the low number of trades, even if it does not form price action, an algorithm that targets ATR multiples pullbacks seems to be effective.

Also, I set the parameters without optimizing anything, but optimizing them seems to balance around +90 pips of profit and -50 pips of loss.

■ Harmonic + Price Action

Backtest results with profit target of 90 pips and stop loss of 50 pips to maximize profit and minimize loss.

| Currency pair | EURUSD (Euro vs US Dollar) | ||||

| Period | 1 hour (H1) 2013.01.02 09:00 - 2016.12.29 23:00 (2013.01.01 - 2016.12.30) | ||||

| Model | All ticks (the most accurate method using the smallest available time frame) | ||||

| Parameters | Sep00=""; MagicNumber=86290001; IsCountdong=false; SpreadFilter=5; Lot=0.1; Slippage=1; MaxPosition=10; Comment="Gewinn9"; Sep01=""; MaxProfit=90; StopLoss=50; MaxOpenBars=240; IsTrailing=false; TrailingStartPips=100; TrailingPips=50; IsBreakEven=false; BreakPips=20; UnRepeatPosition=4; Sep10=""; OpenHarmonicType=-1; LowHighBars=4; | ||||

| Test bars | 25750 | Model ticks | 71993250 | Modeling quality | 90.00% |

| Discrepancy chart error | 0 | ||||

| Initial margin | 10000.00 | Spread | 20 | ||

| Net profit | 1322.42 | Total profit | 4996.46 | Total loss | -3674.04 |

| Profit factor | 1.36 | Expectancy | 9.06 | ||

| Absolute drawdown | 163.91 | Maximum drawdown | 390.36 (3.79%) | Relative drawdown | 3.79% (390.36) |

| Total trades | 146 | Short positions (win rate %) | 73 (52.05%) | Long positions (win rate %) | 73 (47.95%) |

| Win rate (%) | 73 (50.00%) | Loss rate (%) | 73 (50.00%) | ||

| Maximum | Winning trades | 92.28 | Losing trades | -57.27 | |

| Average | Winning trades | 68.44 | Losing trades | -50.33 | |

| Maximum | Winning streak (amount) | 7 (484.70) | Losing streak (amount) | 6 (-299.11) | |

| Maximum | Winning streak (trade count) | 484.70 (7) | Losing streak (trade count) | -299.11 (6) | |

| Average | Winning streak | 2 | Losing streak | 2 | |

The free indicators published on the blog “Studying to win FX on MT4” are available from this list.

Indicator list

Indicator listPlease also follow us on Twitter.

https://twitter.com/mt4program