Combine harmonics and indicators.

■ Harmonic + RCI + Moving Average Divergence

Harmonic is a fairly capable indicator, and even if you just open a position on EURUSD H1 without thinking and close it after 48 hours, the win rate exceeds 50%, and the results are slightly positive.

This in itself is amazing, but for actual trading, I want a bit more.

Therefore, on my blog I introduce combinations with RCI.

[Harmonic] Trading method: Timing with RCI (under study)

According to the Harmonics textbook, combining with RSI is the conventional approach, but RSI tends to stick to price during trends.

Harmonic big losses occur when price sticks during a trend, so using RSI as a trading filter is quite worrisome.

When I actually backtest Harmonic + RSI, in EURUSD H1, 2016 is a big winner, but 2015 is quite a big loss.

We get dragged into a downtrend of EURUSD and the losses accumulate one after another.

The profit is preserved, but a rather large peak forms.

My conclusion is that the Harmonic + RSI combination is clearly effective at times and not at others, so if you use it, you should go back a bit to judge whether it seems effective before applying it.

So, I am continuing to study this in various ways.

For a sharp edge in contrarian strategies and something good, I am considering price action of candlesticks, but besides that, I am focusing on moving average divergence.

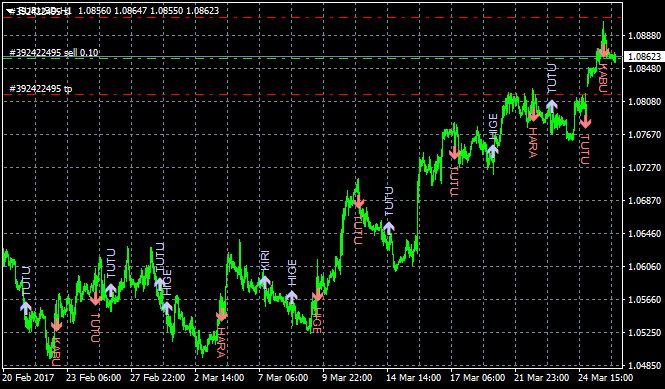

The chart in the image shows Harmonic + Moving Average Divergence + RCI.

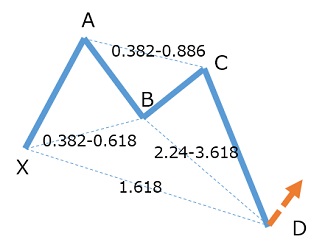

Moving average divergence is

1. abnormal divergence

2. divergence trendline break

The basic idea is contrarian trading targeting these, and I am examining what happens when combined with Harmonic.

Also, the indicators on the image are modified to work with Harmonic,

so that high/low/close divergence and close price standard deviation can be displayed.

I plan to distribute it as a review gift with the upcoming pre-Harmonic display indicator release.

So, I have been revising indicator settings by systematically using backtests, rather than relying on rules of thumb.

If something I think will work ends up failing in backtests, and there is a mismatch with past content, please understand that the latest content reflects the most up-to-date verification.

(Addendum)

While writing the article, the divergence trendline broke and it overlapped with the DC0.127 break, so I opened a short position.

It was an order with the Harmonic pattern detection indicator review gift assistance tool.

(Addendum 2) Unfortunately, it was stopped out once.

Since it was my first trade after the serialization started, I wanted to pull it off stylishly, but it started with a stop loss.