Pound-yen Today's Target Point (December 19th)

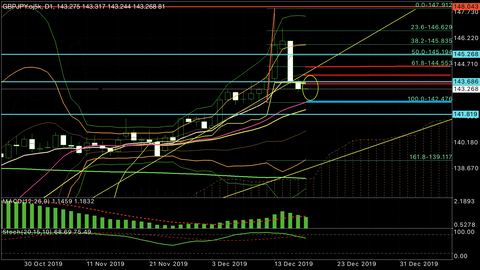

■GBP/JPY, Daily Target Points

On the daily chart, the baseline and the 10 EMA are around143.53 to 143.60as resistance, and if this is surpassed143.87 aroundor a recovery to the 144 handle with +1σ on the144.14 aroundseems likely to rise.

However, even if it retraces, the area around143.53 to 143.60where the baseline and 10 EMA lie may cap the upside, so be cautious, though looking at the 4-hour and other timeframes, there may be a breakout.

If the low of yesterday143.04 aroundis broken, watch for a drop to the middle line around142.47 around.

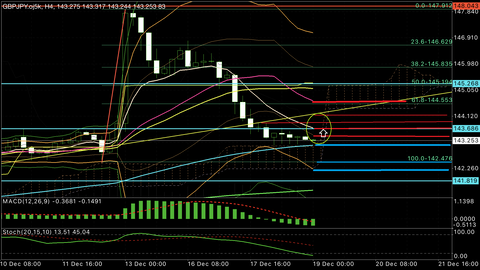

■GBP/JPY, 4-Hour Target Points

Yesterday it bounced at around143.04where the Bollinger Band -2σ, the 90-day moving average, and the upper cloud converge, but the rebound is weak and the price is stuck at a low, so downside risk remains. However, the cloud’s uplift point is coming up, so a rebound is quite possible.

If it clears around143.44to the upside, with the 10 EMA around143.67 aroundit may face resistance here, but if selling does not appear, further upside is expected,143.86 to 143.88,144.00 around,144.17 around, with the middle line at around144.60 to 144.62as the target.

If the 90-day line and the upper cloud hold at around143.06, a break below may signal further downside to around142.78,142.47 around, and the area of -2σ around142.27 around.

Yesterday it bounced at around143.04where the Bollinger Band -2σ, the 90-day moving average, and the upper cloud converge, but the rebound is weak and the price is stuck at a low, so downside risk remains. However, the cloud’s uplift point is coming up, so a rebound is quite possible.

If it clears around143.44to the upside, with the 10 EMA around143.67 aroundit may face resistance here, but if selling does not appear, further upside is expected,143.86 to 143.88,144.00 around,144.17 around, with the middle line at around144.60 to 144.62as the target.

If the 90-day line and the upper cloud hold at around143.06, a break below may signal further downside to around142.78,142.47 around, and the area of -2σ around142.27 around.

☆☆☆ Scatote Fuuta Target Points ☆☆☆

【Sell-into-Rally Points】

1, around 143.44

2, around 143.67

3, around 143.86 to 143.88

【Pivot Line】※A line that is commonly watched and can become a turning point.

Around 143.44

【Pivot Line】※A line that is commonly watched and can become a turning point.

Around 143.44

【Buy-the-dip Points】

1, around 143.09 to 143.06

2, around 142.78

3, around 142.47

※When trading, please be fully responsible for your own actions and proceed with caution!

※When trading, please be fully responsible for your own actions and proceed with caution!

■Today’s Outlook

Today I expect the price to attempt a rebound along the 4-hour cloud.

However, be cautious about selling into rallies; if it is stopped around the 4-hour 10 EMA or the middle line and trades sideways and enters the cloud’s break, then downside risk should be watched. If that happens, a further drop could follow.

Tonight there are UK economic indicators at 21:00, so expect moves around that time and be cautious.

※GBP/JPY is highly sensitive to fundamentals, so when it moves in one sweep, avoid fighting the current and go with the flow!

Well then everyone, let’s continue to proceed cautiously today as well—thank you!!

――――――――――――――――――――――――――――――――――――――――――――

Scatote Fuuta’s Daily Market Bloghttp://fxfighter-fuuta.link/

Scatote Fuuta’s Technical Study HPhttp://fx-fuuta.com/

Scatote Fuuta’s Twitter@fuuta_fx_trader

――――――――――――――――――――――――――――――――――――――――――――

◆◆◆ Highly Popular Indicator!! ◆◆◆

1. An indicator that tells you the perfect timing, something not seen before

2. A new series: Victory.ver Indicator

× ![]()