Pound-Yen: Next Week's Target Point (December 8)

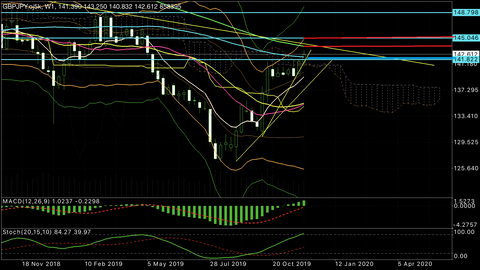

■GBP/JPY, Weekly Target Points

If there is no large gap opening at the start of the week, it will begin between the 90-day line (142.22 near) and the 200-day line (143.80 near), so moves within this range will likely be watched.

Initially, it might pull back to around the 90-day line,142.25 to 142.22, or to around142.00, and then rebound to push to new highs, reaching143.00 near or toward the 200-day line at143.70 to 143.80. If it continues to rise, the upper target remains the same.

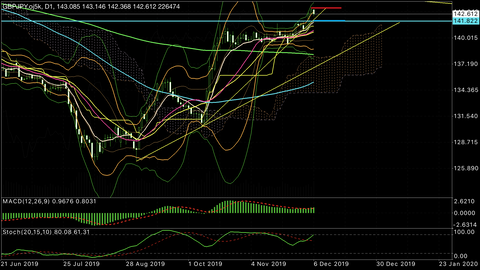

■GBP/JPY, Daily Target Points

Friday failed to rise and closed with a bearish tilt, so at the start of the week we should be cautious of a pullback as the daily candle is a bearish engulfing pattern.

The Bollinger Bands are expanding, so while expecting upside, look for dip-buying points, with the breakout point around141.80 near, which also has the middle line, so observe whether it rebounds.

However, if it does not fall to around141.80, and may instead rebound at the neckline around142.38, around142.25142.00, or the round-number around, you should anticipate a possible rebound.

After the rebound, the targets appear to be around142.80 near,143.00 to 143.07 near, and if theFriday opening level of143.07 near is surpassed, there is +3σ up to around143.70 to 143.80 near.

In the 143-yen range, even if reached, the breakout is likely to be preceded by a period of consolidation aroundaround 143.00 before rising further.

Friday failed to rise and closed with a bearish tilt, so at the start of the week we should be cautious of a pullback as the daily candle is a bearish engulfing pattern.

The Bollinger Bands are expanding, so while expecting upside, look for dip-buying points, with the breakout point around141.80 near, which also has the middle line, so observe whether it rebounds.

However, if it does not fall to around141.80, and may instead rebound at the neckline around142.38, around142.25142.00, or the round-number around, you should anticipate a possible rebound.

After the rebound, the targets appear to be around142.80 near,143.00 to 143.07 near, and if theFriday opening level of143.07 near is surpassed, there is +3σ up to around143.70 to 143.80 near.

In the 143-yen range, even if reached, the breakout is likely to be preceded by a period of consolidation aroundaround 143.00 before rising further.

■Next Week's Outlook

The basic stance is to stay bullish, but a pullback is possible, so we want to target buy-the-dip entries. However, since the daily chart shows a bullish engulfing pattern, at the start of the week there may be selling pressure, and if the rebound at dip levels is weak, be cautious of a decline.

GBP/JPY is volatile, so wait for the point to be reached and be careful of counter-trend trades, aiming for a trend-following approach.

※GBP/JPY is susceptible to fundamentals, so when it moves sharply, beware not to fight the trend!!

Well then everyone, let's stay careful and do our best today as well!!

――――――――――――――――――――――――――――――――――――――――――――

Scaletrade Fuuta's Daily Market Bloghttp://fxfighter-fuuta.link/

Scaletrade Fuuta's Technical Study HPhttp://fx-fuuta.com/

Scaletrade Fuuta's Twitter@fuuta_fx_trader

――――――――――――――――――――――――――――――――――――――――――――

◆◆◆ Popular Indicator!! ◆◆◆

1. An indicator that tells you the timing like never before

2. The never-before series Victory.ver Indicator

× ![]()