Pound/Yen today's target point (December 17)

■Pound/Yen, Daily Target Points

Since the low of yesterday has already been breached, be cautious of a downside. On the daily chart the price range to the target point is wide, so we should be mindful of Fibonacci points...

There is 50% retracementaround 145.21, first observe whether there is a rebound around this half-fib level. If the rebound is weak,near 145.00, near 144.90, 61.8%around 144.57, be cautious of a drop to around there.

If the yesterday’s lowaround 145.55 to 145.60is breached,around 145.85, where the daily chart has +2σ,around 146.00 to 146.05seems likely.

If the upside remains heavy for a long time, be prepared for a possible downside!

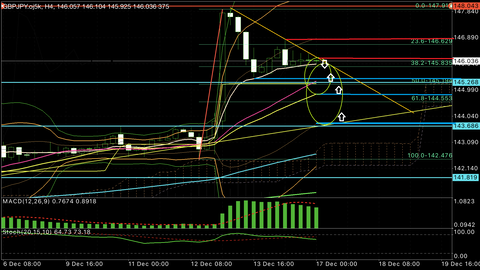

■Pound/Yen, 4-Hour Target Points

From around 146.80, the price has been trending lower and has broken below around 145.85, where the 10 EMA is located.

Above, around 145.85 near the 10 EMA and the 38.2% Fibonacci level will act as resistance, while below, around 145.30 with the middle line will act as support.

If the middle-line areaaround 145.30is breached, the Fibonacci 50% ataround 145.20,around 145.00, and the 25-day moving average aroundaround 144.85may come into play. Any of these could cause a rebound in the near term, but pound-yen can move strongly once it starts, so wait for a clear bounce on lower timeframes before entering.

If it surpasses the area around145.85 (10 EMA and 38.2% fib),146.00 to around 10, note that there is also +2σ on the daily chart, so be careful of pullbacks; if it breaks above this,around 146.35,around 146.45, around 146.60, there will likely be +1σ aroundaround 146.80.

From around 146.80, the price has been trending lower and has broken below around 145.85, where the 10 EMA is located.

Above, around 145.85 near the 10 EMA and the 38.2% Fibonacci level will act as resistance, while below, around 145.30 with the middle line will act as support.

If the middle-line areaaround 145.30is breached, the Fibonacci 50% ataround 145.20,around 145.00, and the 25-day moving average aroundaround 144.85may come into play. Any of these could cause a rebound in the near term, but pound-yen can move strongly once it starts, so wait for a clear bounce on lower timeframes before entering.

If it surpasses the area around145.85 (10 EMA and 38.2% fib),146.00 to around 10, note that there is also +2σ on the daily chart, so be careful of pullbacks; if it breaks above this,around 146.35,around 146.45, around 146.60, there will likely be +1σ aroundaround 146.80.

☆☆☆ Scatire Fuuta Target Points ☆☆

【Sell-into-Rally Points】

1、Near 145.55 to 145.60

2、Near 145.85

3、Near 146.00 to 146.05

【Pivot Lines】※There are lines that traders often watch as turning points.

Around 146.27

【Pivot Lines】※There are lines that traders often watch as turning points.

Around 146.27

【Dip-Buy Points】

1、Around 145.30

2、Around 145.20

3、Around 145.00

※When trading, please do so at your own risk and take utmost care!

※When trading, please do so at your own risk and take utmost care!

【Fibonacci Points】

23.6% around 146.66

38.2% around 145.86

50% around 145.21

61.8% around 144.57

■Today’s View

Today, the bias looks to be more on the selling side, leaning downward, but around the early 145s (half retracement) there could be some support, so stay cautious.

If selling intensifies, there could be a drop toward the daily 10 EMA or +1σ aroundaround 144.00as well!

※The pound-yen is highly influenced by fundamental factors, so when movement is rapid, avoid fighting the trend!

Well then, everyone, let’s be cautious today as well. Please take care!!

――――――――――――――――――――――――――――――――――――――――――――

Scatire Fuuta’s Daily Market Bloghttp://fxfighter-fuuta.link/

Scatire Fuuta’s Technical Study Homepagehttp://fx-fuuta.com/

Scatire Fuuta’s Twitter@fuuta_fx_trader

――――――――――――――――――――――――――――――――――――――――――――

◆◆◆ Popular Indicators Coming Soon! ◆◆◆

1. An indicator that tells you the perfect timing never before seen

2. Victory.ver indicator, a new series

× ![]()