Natural rubber aims to reach a year-to-date high [Ryuji Sato]

Ryuji Sato Profile

Sato Ryuuji. Born in 1968. After graduating from a US university in 1993, he joined a marketing company and then entered Genesis Co., Ltd. (later Oval Next Co., Ltd.), a information vendor for finance and investments, where he wrote analyst reports on macroeconomic analysis, exchange rates, commodities, and stock markets, and participated in trading. In 2010, he founded “H-Square Co., Ltd.,” wrote analyst reports and planned/published works such as “FOREX NOTE Currency Handbook,” while also serving as a radio host on investment-related programs. Individual trader. Certified Technical Analyst by the International Federation of Technical Analysts. Main host on Radio Nikkei’s “The Money Doiato’s Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Sato Blog

*This article is a reprint/edit of a FX攻略.com January 2020 issue article. The market information written in the text may differ from the current market situation, so please be aware.

Will it aim to surpass 210 yen by breaking the year-to-date high?

In the December 2019 issue, natural rubber futures were said to show signs of upside related to the contango, and since then they have risen by more than 23%. There are signs of changes in supply-demand balance, suggesting a potential for further upside from here. In this issue, I would like to forecast the future of the rubber market, which is rising with the momentum to test the year-to-date high.

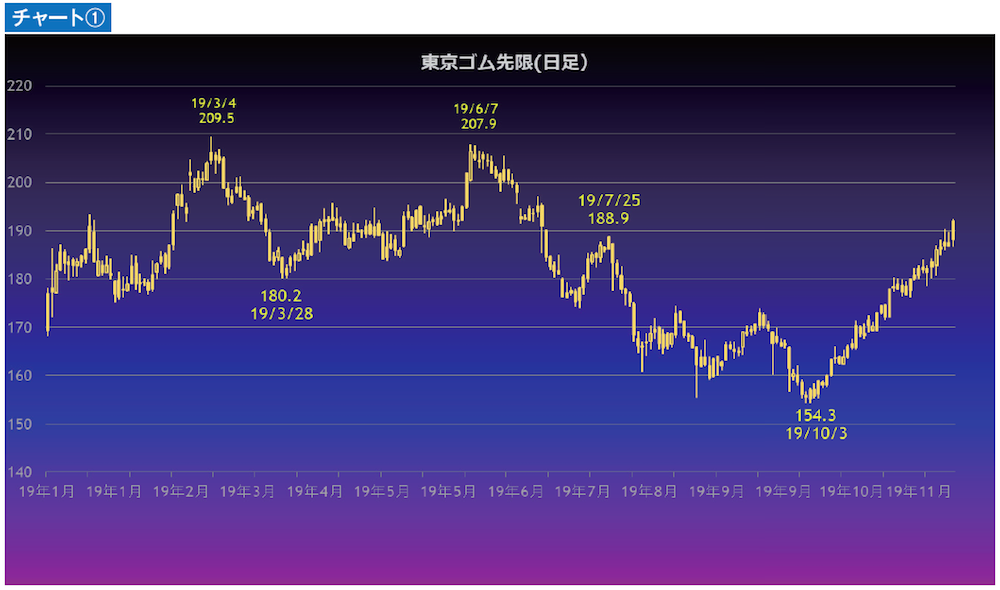

First, let’s briefly review the major trend of natural rubber prices in 2019 using the Tokyo Rubber futures daily chart (quote value per 1 kilogram) (see Chart ①). At a glance, a double top is formed at 209.5 yen on March 4 (year-to-date high) and 207.9 yen on June 7. Behind the March rise was last November’s decision by producing countries to cut exports as a countermeasure to price declines in natural rubber. The actual export cuts began in April this year, but by then the move had already been priced in and the price fell. Later, concerns about production cuts due to El Niño tightened the market again in June, but as production recovered the price gradually declined. Moreover, due to the impact of US-China trade friction, views spread that demand for natural rubber, led by automobile tires, would slow, and on October 3 the price fell to 154.3 yen, the lowest since November last year.

From here, the rally began, and by November 26 it rose to 192.5 yen. A rapid rise of about 40 yen in just under eight weeks. In the meantime, there were no real pullbacks and it rose in a straight line; on the weekly chart as of November 22, it had 7 consecutive weeks of gains. If the uptrend continues, there is a possibility of testing the above-mentioned year-to-date high of 209.5 yen.