GBP/JPY Target Point for Next Week (December 1)

November's GBP/JPY traded in a narrow range, but it was holding up well!

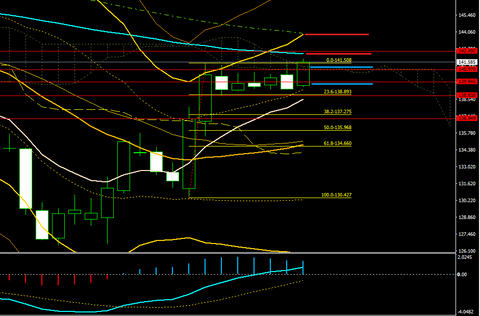

On a monthly chart, it moved from above the 10 EMA toward the middle line, finishing near 141.58 with the price almost glued to the middle line.

There are gaps to consider, but if December starts with the price below the middle line at the beginning of the week, there is a possibility of a retreat, though the current trend could break straight through the middle line.

Beyond the141.80 around, if it can push into the 142 area, there is also the 25-day moving average nearby at143.40 around, and if momentum strengthens, there might also be147 around for GBP/JPY?!

If it struggles around the141.80 aroundwhere the middle line sits, we should watch for a drop toward the November lowaround the 139 handle.

On a monthly basis, it may pull back once, but the overall bias remains higher.

■GBP/JPY, Weekly Target Points

This week it rose from +1σ of the Bollinger Bands and hit new highs, piercing the Ichimoku cloud, so at the start of next week it may be supported near141.25 aroundas the cloud’s upper limit, or it may continue higher to142 handle, aiming for a break higher.On a monthly chart, it moved from above the 10 EMA toward the middle line, finishing near 141.58 with the price almost glued to the middle line.

There are gaps to consider, but if December starts with the price below the middle line at the beginning of the week, there is a possibility of a retreat, though the current trend could break straight through the middle line.

Beyond the141.80 around, if it can push into the 142 area, there is also the 25-day moving average nearby at143.40 around, and if momentum strengthens, there might also be147 around for GBP/JPY?!

If it struggles around the141.80 aroundwhere the middle line sits, we should watch for a drop toward the November lowaround the 139 handle.

On a monthly basis, it may pull back once, but the overall bias remains higher.

■GBP/JPY, Weekly Target Points

If it can push into the142 area, the 90-day line sits around142.28–142.30, and further up, the 200-day line around143.50smight come into view.

MACD is entering a positive zone, which should provide additional support!

However, Ichimoku clouds are thin, so if price breaks below the cloudnear 140.90, watch out for a decline toward +1σ around140.00.

Weekly basis, price is moving from a sideways to an upside bias.

If it starts below +2σ, then +2σ could act as resistance and keep upside pressure tepid; caution toward a drop toward +1σ near141.00.

At the start of the week, confirm the rate around +2σ. Will it be around141.50?!

MACD looks set for a golden cross, which should provide a tailwind, so I expect an upside breakout at the start of the week.

■Next Week’s Outlook

Next week I’m leaning toward a pulling-back buy with a bullish bias.

As a new month begins, price could move aggressively, but on a 4-hour chart, around 142, there may be some pressure, so Monday may see the price move from the mid-140s toward the upper 140s to around 142, then in the New York session or from Tuesday onward push into the 142s!?

GBP/JPY has momentum—what will happen? For now, I’m expecting an upward move.

Since next week starts a new month, I’ll take a wait-and-see approach initially. The market might be tricky at the start of the month, so be especially cautious and aim for calm trading windows.

※GBP/JPY is easily influenced by fundamentals, so if it moves sharply, be careful not to fight the trend!

――――――――――――――――――――――――――――――――――――――――――――

Scaletrade Fuuta’s daily market bloghttp://fxfighter-fuuta.link/

Fuuta’s technical study homepagehttp://fx-fuuta.com/

Fuuta’s Twitter@fuuta_fx_trader

――――――――――――――――――――――――――――――――――――――――――――

1) An indicator that tells you exquisite timing like never before

2) A new series Victory.ver Indicator

× ![]()