Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [Theme of this month | Breakout predictions in range-bound markets and methods for setting target p

The dollar-yen is in a downtrend forming due to rising political risks such as President Trump’s protectionist policies and the Moritomo event that unsettles the Abe administration. Nevertheless, recent dollar-yen movements have not collapsed in a single plunge; instead, after breaking the lower end of a range and falling, they often form another range at the lower levels. In this article, we will explain how to forecast range-bound markets and their breaks, and how to identify target rates.

*This article is a reprint and revision of an article from FX攻略.com, June 2018. Please note that the market information in the text may differ from current market conditions.

Profile of Masa Kazu Sato

Sato Masakazu. After working at a Japanese bank, he joined BNP Paribas (formerly Paribas) in Paris. He has served as an interbank chief dealer, head of liquidity, senior manager, and other roles. He later became Senior Analyst at FX Online, which boasts the highest yearly trading volume. He has been involved in the currency market for over 20 years in total. Appears on Radio Nikkei’s “Live Stock Commentary! Stock Channel” and Stock Voice’s “Market Wide—Foreign Exchange Information,” and regularly provides market information on Yahoo! Finance.

What is a Downtrend Formed by Range-Bound Market? Trading Strategies at the Lower Break and Methods for Determining Price Ranges

With rising political risks such as the U.S. Trump administration’s protectionist policies and a hard stance on foreign matters, and in Japan with the Moritomo documents alteration triggering talk of “Abe Exit,” the dollar-yen continues to show signs of testing new lows as risk factors mount.

Even the likely thriving U.S. economy showed signs of cooling, as February retail sales fell 0.1% month over month, underperforming expectations for the third consecutive month. The Atlanta Fed’s GDPNow forecast for January–March 2018 growth slipped to 1.9% (from 2.5%). Given that the U.S. economy’s recovery has already entered its 10th year, some even speculate that growth could enter a recession after 2019 when viewed within the economic cycle.

As political risk and recession risk rise, the yen tends to be bought, pushing the yen higher. However, because the interest rate differential remains a strong driver of dollar strength, even though many signals indicate a downtrend, the dollar-yen does not crash abruptly; instead it forms a range, repeatedly breaking the lower end to make new lows.

Moreover, the uptrends in euro-dollar and euro-yen since 2017 are not a sharp surge but rather form a stepping-stone range, moving up and down. In this article, we will examine analytical methods that can be used to forecast range-bound movements and their breaks to the downside or upside, and how to identify target rates after breaks.

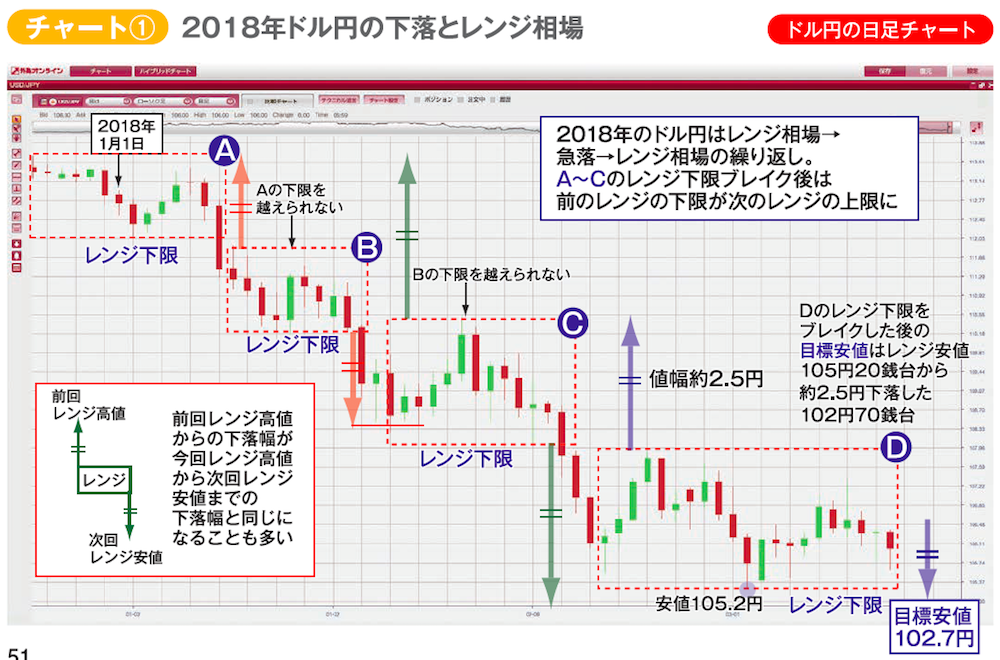

Chart ① shows the daily chart of dollar-yen since the start of 2018. Without resorting to complex technical indicators, the dollar-yen has been moving in a cycle of range-bound market → sharp drop → again range-bound → another sharp drop. In the ranges A–C shown on Chart ①, after breaking the range bottom and plunging, it falls to the next range’s low and reverses upward. However, it cannot rise back up to the previous range’s low and stalls, eventually breaking the newly formed range bottom and continuing to decline. In other words, the trading strategy for this range-bound downtrend is two-fold: “sell decisively when the lower bound is broken” and “sell on the topside in a reversal up to the previous range’s lower bound.”

As indicated by the upper and lower arrows, the price range from the lower bound to the next low often equals the downward move from the previous range’s high to the range’s upper bound. When a further collapse occurs after a first plunge and a subsequent range, be mindful of the rule that the second plunge often mirrors the first in magnitude. This awareness helps to estimate how far the price may fall. It won’t always be exact, but if you can establish a target, it will make trading substantially easier. By applying this method of setting target ranges, if the dollar-yen breaks downward from the D range in the future, the target low is around 102.70 yen. It would be prudent to keep this target in mind.