【Anyone Can Understand Buy Signal】Enter in parts without taking a full position, enter systematically, and cut losses with a “NANPIN Box” [Kawasaki Doraemon]

Kawasaki Dollemon Profile

Feeling limits with discretionary trading, he searched for a system trading method that could be profitable with as little psychological burden as possible and without effort. After various simulations, he completed the Gurgle Train.

Blog:http://kawasakidoruemon.com/

Twitter:https://twitter.com/kawasakidoruemo

※This article is a reprint/edit of an article from FX攻略.com January 2020 issue. Please note that the market information described in the text may differ from the current market.

※The "Points of Strategy" and the main text assume a long position in an upward phase. In a downward phase with a short, the reverse rules apply.

Points of Strategy

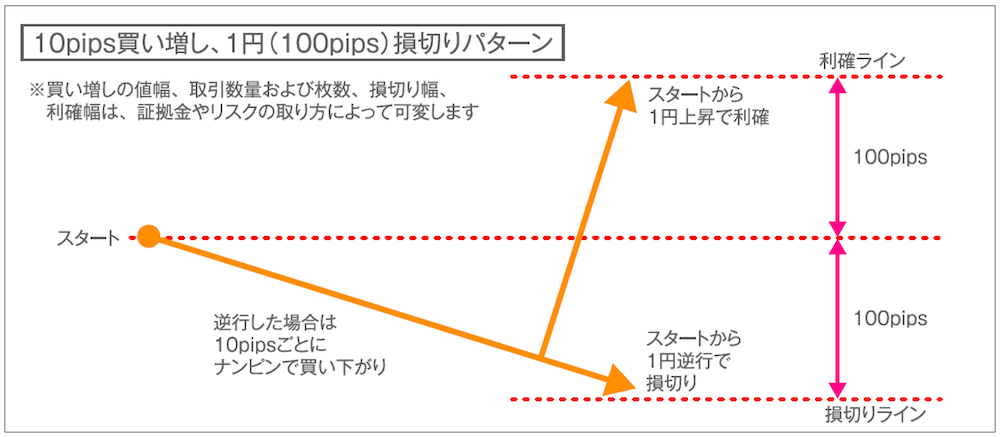

- Strategy: Planned Averaging Down

- Trading Timeframe: Mainly 1-hour chart

- Target Currency Pair: GBP/JPY (those with volatility)

- Benefits of this strategy: Limits losses and allows taking advantage of averaging down

New

- Buy more each time it moves against by 10 pips (maximum of 10 positions)

Stop Loss

- If it moves against from the start to -100 pips, stop all losses at once

Take Profit

- If it moves +100 pips from the start, take profit all at once

Using Averaging Down Effectively

What Kawasaki Dollemon taught was the idea of planning to use averaging down by adding to positions when held positions and prices move against us, thereby lowering the average entry price.

This trading idea involves holding positions in smaller chunks rather than all at once, so even if the predefined stop loss is reached it can reduce losses compared to conventional trading methods. Also, if the price reverses from a drawdown and there is a chance to secure profits, this approach can potentially yield profits over a broader range than conventional methods.

Averaging down is considered risky, but when used in a planned manner in combination with proper money management, it can be an effective technique.