Palladium remains at historically high levels [Ryuuji Satou]

Ryuuji Sato Profile

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined a marketing company, then moved to a financial and investment information vendor, Genesix Co., Ltd. (later Oval Next Co., Ltd.). He has written analyst reports on macroeconomic analysis, forex, commodities, and stock markets, and has been involved in trading. Since 2010, he founded “H Square Co., Ltd.”, writing analyst reports and planning/publishing publications such as “FOREX NOTE Currency Handbook,” while also serving as a radio program host related to investments. He is an individual trader. International Federation of Technical Analysts – Certified Technical Analyst. Main host of Radio Nippon’s “The Money Doisat Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Sato Blog

※This article is a reprint/edit of FX攻略.com January 2020 issue. Please note that the market information written in the main text differs from the current market.

Supply shortage remains severe

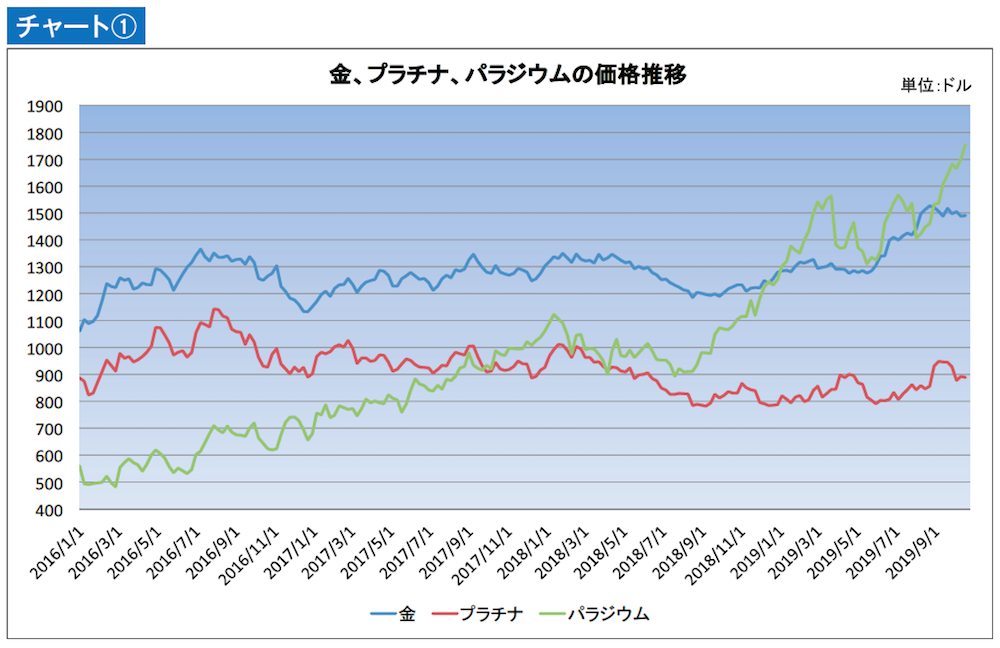

In the March 2019 issue, we reported that for the first time in 16 years, palladium had risen above gold in price. At that time, palladium was deemed to have a good chance of reaching the $1,300 range. However, palladium’s subsequent rise surpassed expectations, reaching $1,782 on October 17, 2019 (see Chart 1). Moreover, the price gap with platinum has widened to nearly double. This time, let's forecast palladium's continued rise and its future.