A huge chance to increase assets! Coming soon!! The big market 【4】 Euro vs Dollar aiming for 1 to 1!? Current, past, and future of the EUR/USD exchange rate

Prepare Funds to Make Big Profits!

If you continue investing for a long time, you will likely encounter a “major market” somewhere along the way. For traders, it’s a once-in-a-lifetime big opportunity to gain substantial profits. What if such a major market were to come in the near future?

This time, to react and prepare quickly for a major market, we will explain why a major market is near, the changes occurring in each market, and provide chart analysis for the USD/JPY and EUR/USD pairs. Please save up funds and seize the upcoming major market!

※This article is a reprint and revision of an article from FX攻略.com December 2019 issue. Please note that the market information written here may differ from the current market.

Supervised by the Osaka Chart Doctor! Profile of Masao Shindo

Working as both strategist and technical analyst under Kojiro Tezuka, who serves as the representative of Tezuka Koji Office Co., Ltd. Posts various chart analysis ideas on TradingView.

Twitter:https://twitter.com/masao_shindo

Table of Contents – A Great Chance to Grow Your Assets! An Imminent Major Market

【1】Whether it goes up or down isn’t the key! What to discern is whether it moves or not

【4】EUR/USD aiming for 1-to-1!? The current, past, and future of the EUR/USD

Unlike USD/JPY, the selling trend is stronger

USD/JPY had been in a range with no clear trend, so next we will look at the market situation of EUR/USD, which is said to have the world's largest trading volume.

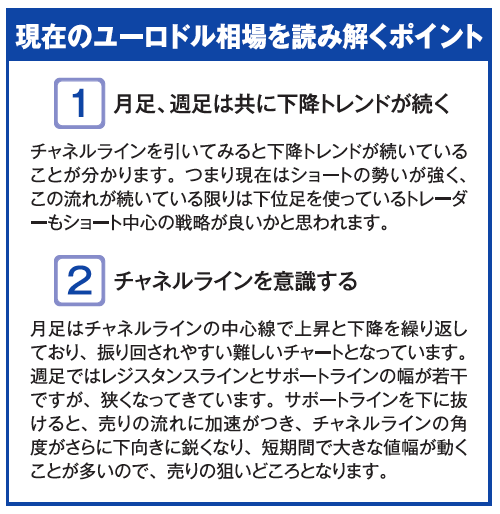

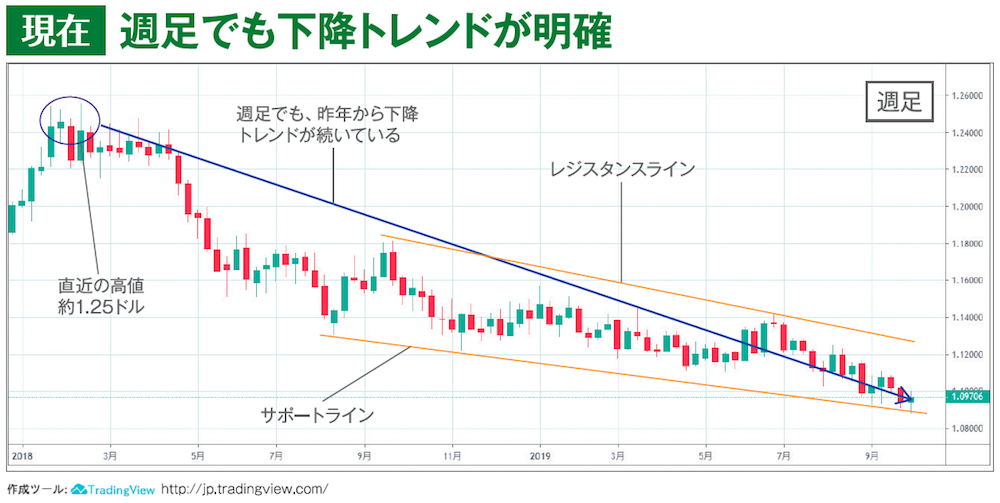

Currently, EUR/USD is seeing strong selling pressure due to political risks from Brexit and economic concerns in Europe stemming from US-China trade frictions. Looking at the monthly chart, there has been a downtrend for about ten years, and on a weekly chart, the downtrend has continued since last year. If this situation continues, trading short on both long-term and short-term timeframes becomes effective.

Looking ahead, if the price breaks the resistance line, a trend reversal or a phase of range-bound movement could occur. Conversely, if it breaks the support line, further declines are expected.