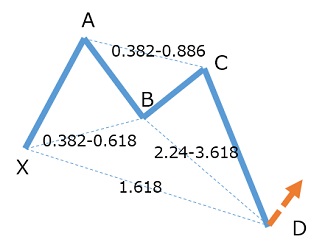

Fundamental Harmonic Trading Rules

I would like to write about the basic trading rules of harmonic patterns.

The most fundamental entry decision is to enter at 0.127 after a harmonic pattern appears and to close at the 0.618 line.

■ EURUSD H1 Black Swan 2017/03/21

As for stops, placing them at point D is the basics, but recently, perhaps because harmonic patterns have become popular, there are many stop hunts at point D. This also occurred on the 22nd in the image above.

There are times when it is quite pronounced, like this.

Therefore, recently it has become common to place the stop one notch above the deeper of point X or point D (if they are too close, place it two notches higher).

If price moves in that direction, set the breakeven early.

As a guideline, overshooting the 0.382 line is common, but depending on the shape, it can be farther away, so I set the breakeven about +10 pips.

Now, with the beta version of the pre-harmonic pattern display indicator currently in testing, you can display lines that look like harmonic patterns.

From that, it seems like it would form a 5-0 pattern around 1.0741.

From the DC0.618 of the black swan at 1.0757 to 1.0741, is this a zone that could be harmonically viewed as a temporary zone? And how far away would the next harmonic appear? These are things that can be checked.

This article was written around 14:00 on 2017/3/24. By the time the article is published, the outcome may already be determined.

# Addendum 3/25

Seems like there was a rebound near 1.0760 just before 0.618.

Indicator to display harmonic target positions — Beta version

(Available through end of March 2017)