My range market strategy [Oval Prime K.T]

About 70% to 80% of the foreign exchange market is said to be range-bound, where prices move up and down within a certain range. Unlike trending markets, range markets have no clear direction and small price movements, which often makes them difficult for traders to master. In this article, Oval Prime FX trader Oval Prime K.T explains range market strategies.

This article is a republication and rewriting of an article from FX攻略.com, August 2018 issue. Please note that the market information described in the text may differ from the current market conditions.

Kousuke's Profile

Kousuke. Certified Member of the Nippon Technical Analysts Association (CMTA®) in Japan, won 3rd place in the World Trade Contest WTC (Robins Cup); ranked 1st in the GoGoJungle indicator sales rankings; Monex Securities tie-up; backed by Credit Suisse Group Dexa Copy Japan; appeared on Radio Nikkei, etc.; currently sharing a 5-minute chart day trading logic “Proto-RT FX.” The logic's clarity and accuracy, plus member-only video distributions, are well received, with more than 1,700 members today.

Official site:https://oval-prime.co.jp/kousuke/

Twitter:https://twitter.com/kousuke_trader

Two Reasons Why Ranges Are Important in the FX Market

Hello everyone, nice to meet you. This is my first time contributing to FX攻略.com. I have long been an avid reader of this magazine, and I’m very happy to participate.

Now, without further ado, I’d like to talk about my range market strategy. There are many opinions in the market, such as “don’t trade in range markets” or “take a break from trading during ranges,” but I believe ranges are the most important in the world of markets.

One reason ranges are important is that a “range breakout” is the moment that can trigger stop losses. Traders who hold either a long or a short position are at risk of losing money at this moment.

Why do long and short positions accumulate in ranges? Because within a range, traders’ expectations clash. As a result, positions for buys and sells accumulate, creating a large stop loss. As shown above, the areas where others lose money are precisely the opportunities to profit. This is the first reason.

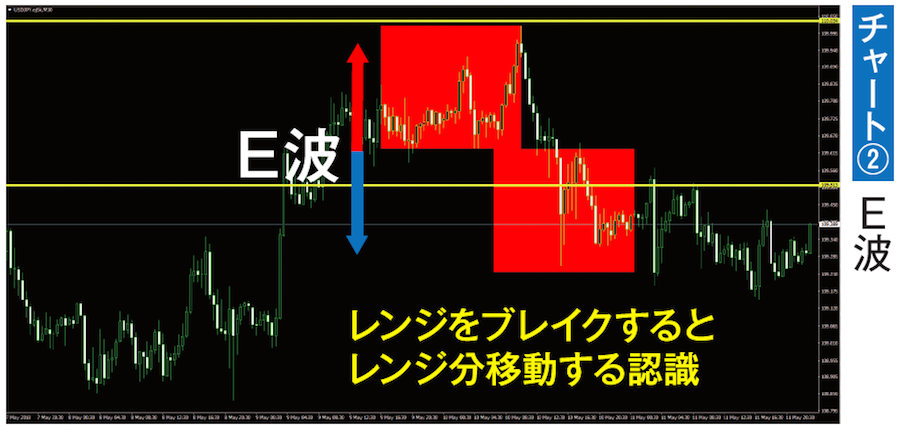

A second reason is that recognizing the correct range allows you to accurately identify future price movement points. For example, recognizing N-waves (Chart 1) or E-waves (Chart 2) becomes clearer when you understand the range. Charts are formed by clusters of ranges; once you recognize the correct range, your chart recognition ability improves.