Although it’s cliché, what will be the next currency crisis? [Jiro Ota]

Profile of Jiro Ota

Jiro Ota. FX strategist. He began FX trading in 1979 at The First National Bank of Boston Tokyo Branch. Later, he worked in corporate foreign exchange at Manufacturers Hanover Trust Bank, BHF Bank, National Westminster Bank, and ING Bank, after which he engaged in retail FX, worked in sales at GFT Tokyo, later gaining experience as a market strategist, and is currently active as an individual investor.

※This article is a reprint and revision of an article from FX攻略.com August 2018 issue. Please note that the market information written in the main text may differ from the current market.

Unexpected dollar strength, continued U.S. rate hike environment

21 years since the Asian currency crisis, 10 years since the Lehman shock, and five years since the "Bernanke shock"—the U.S. economy remains on an expansionary fiscal path with large tax cuts and increased spending, and U.S. interest rates continue to rise, with the possibility of 2–3 more rate hikes this year.

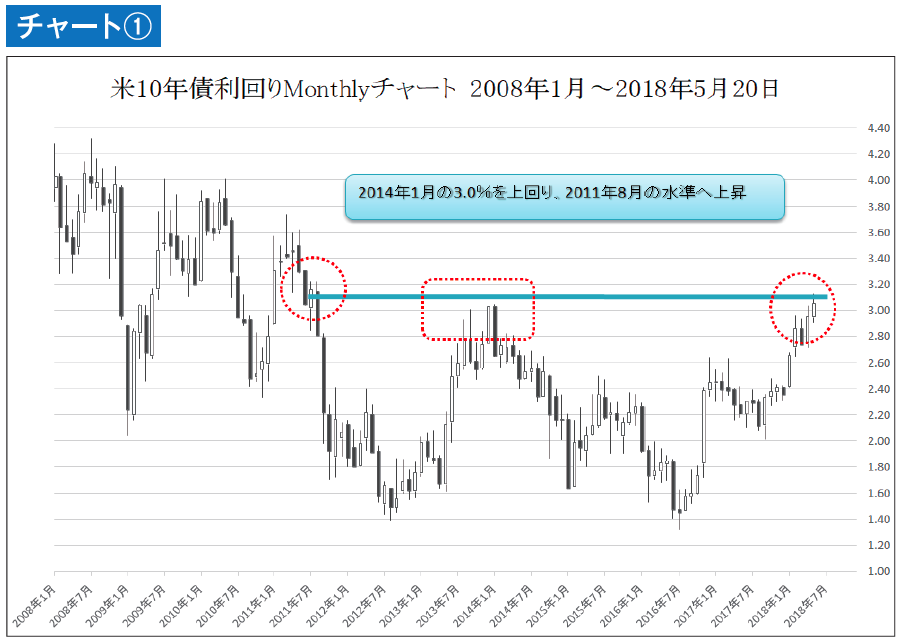

The U.S. 10-year yield surpassed the key level of 3.0% in April, aiming for 3.22% hit in August 2011, and the U.S. 2-year yield reached the big milestone of 2.5%, reaching levels just before the Lehman shock in August 2008 (see Chart 1, Chart 2).

The exchange rates moved unexpectedly toward dollar strength, and currencies of some emerging economies such as Argentina and Turkey updated their lows despite hedging measures and rate hikes. Major currencies show individual factors: since the start of this year, EUR/USD fell from 1.2555 to 1.1750 by 80.5 points (about 6.4%), GBP/USD fell from 1.4377 to 1.3457 by 92.0 points (about 6.4%), and AUD/USD fell from 0.8136 to 0.7412 by 72.4 points (about 8.9%)—highlighting the strength of the dollar (as of May 18, 2018).