EA development specialists explain clearly and carefully! A beginner’s course on automated trading from zero — Part 11: Run EAs with a long-term perspective [FX Noble]

FX Noble's Profile

Shifting from discretionary trading to automated trading, since 2017 an EA developer listing on GogoJungle. From the flagship work “Scalping Dragon” to more than 1,000 sales in total, and continues to publish various information about automated trading on blogs and Twitter.

Official Blog:FX Noble's EA Development Blog

Twitter:https://twitter.com/yenpetit

*This article is a reprint/edit of an article from FX攻略.com November 2019 issue. The market information written in the body is different from the current market, so please be aware.

Even a winning logic can go on a losing streak

No matter how excellent an EA is, temporary drawdowns (reduction of funds) are unavoidable. Many people imagine steadily increasing assets each month at a constant pace, but in reality drawdowns over several months can and do occur. Therefore, it is important to be mentally prepared for temporary trading slumps.

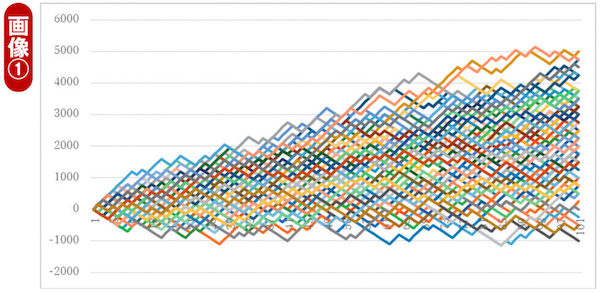

You might find it curious, but an actually advantageous (winning) logic can still lose for a long period. For example, consider a strategy with win rate 50%, win amount 150 yen, loss amount 100 yen. The profit factor (PF) of this strategy is 1.5, and the risk-reward ratio is 3:2. Under these conditions, let's look at the simulation results for 100 trades across 100 sets (Image ①).

Most trades are profitable, but in some results there are losses after 100 trades. PF of 1.5 is not a low value, but this simulation shows that with bad luck you can have prolonged periods of poor performance.