Active FX traders answer anything! Everyone's Q&A [Traders Securities Everyone's FX Igu Kio]

There’s no one to bounce questions off of, and even after researching, I still don’t understand well... If you have such concerns, leave it to this project. Mr. Inoguchi from Treider’s Securities will solve your questions for you!

Mr. Yoshio Inoguchi Profile

Iguchi, Yoshio. Treiders Securities Market Division, Trading Desk. Certified Technical Analyst. He has been involved with financial institutions since 1998, mainly in the covering dealing operations focused on the commodity markets of precious metals and petroleum products. He joined Mijin the FX in 2009 and has conducted dealing operations focusing on USD/JPY and major European currencies. He is renowned for forex analysis from a fundamentals perspective and is also well-regarded for short-term forecasts using technical analysis. Recently, he has appeared in Mijin no FX’s free online seminars, where his easy-to-understand lectures have been well received. Moreover, on Twitter, pro dealers share real-time opinions about the market, so it’s a must-check.

Twitter:https://twitter.com/yoshi_igu

※This article is a republication/edit of an article from FX攻略.com, September 2018 issue. Please note that the market information written in the body may differ from the current market.

Q23. Are there economic indicators or important events to watch in the second half of 2018? (Tokyo / Male, 40s)

A. The biggest event to watch in the second half of 2018 is the U.S. midterm elections in November. Let’s outline a strategy ahead of the midterms.

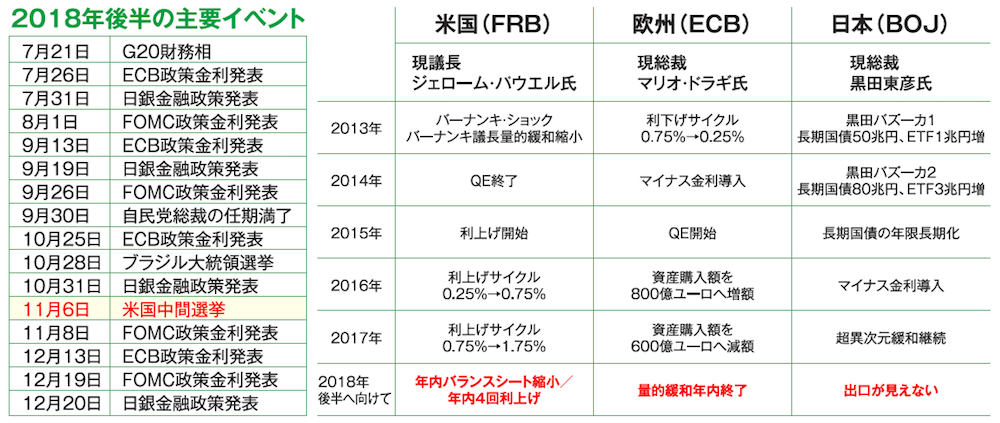

Policy interest rate announcements by the U.S., Japan, and Europe are coming in rapid succession

Toward the end of the year, the main events are as follows. Since there are many policy rate announcements from the U.S., Japan, and Europe, let’s first review the current monetary stance. Looking at monetary policy in the U.S., Europe, and Japan since 2013, the United States began raising rates earlier on the back of strong fundamentals, and the Eurozone has signaled the end of its quantitative easing within the year, showing an exit path. Japan, however, has not yet reached its target inflation rate of 2% and has not even seen a clear exit in sight—this is the current status.

Compared to the dollar and yen, with the U.S. pricing in four rate hikes this year and Japan showing no clear direction, the monetary policies are the exact opposites, so simply speaking, the USD/JPY is expected to rise toward the end of the year. Of course, the USD/JPY could follow this rising scenario, but this year there is a troublesome event ahead: the U.S.–China midterm elections on November 6.