The Future of Foreign Exchange Markets Episode 101 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economics analyst. Alfianuts President and Representative Director. Born 1964 in Tokyo. After graduating from Keio University, he shifted career from Mitsubishi UFJ Securities, where he had worked, and now analyzes and researches a wide range from finance and economics to strategic corporate management, and even personal asset formation and fund management. He serves as a lecturer for lectures, seminars, and training hosted by private enterprises, financial institutions, newspapers, local governments, and various商工団体, with about 150 lectures per year. He has written numerous serialized pieces and comments in print media such as Shukan Gendai “The Rules of Net Trading,” Examinina “Money Maestro Training Course,” and more. He has also written columns on many websites about stocks and foreign exchange and is highly regarded as a stock and FX strategist. He has also been the author for the Home Economics section of “Basic Knowledge of Contemporary Terminology” published by Jiyu Kokuminsha. After regular appearances on TV (TV Asahi “Yajiuma Plus,” BS Asahi “Sunday Online”) and radio (Mainichi Broadcasting “Tachimachi’s Asai-chi Radio”), he currently serves as a regular commentator on Nippon Telegraph and Telephone Network CNBC “Market Wrap” and Daiwa Securities Information TV “Eco-no Market,” among others. His major DVDs include “Super Easy: Tomotaro Tajima’s FX Introduction” and “Super Easy: Tomotaro Tajima’s FX Practical Technical Analysis.” His major books include “Wealth Reassessment Manual” (Paru Publishing), “FX Chart ‘Formula for Profit’” (Alchemix), “Why Can FX Make You Asset Rich?” (Text), and many others. His latest publication is “How to Make Money Riding the Rising U.S. Economy” (Jiyu Kokuminsha).

*This article is a republished and edited version of an article from FX Tactics.com September 2018. Please note that the market information described in the text may differ from current market conditions.

After all, EUR/USD Was Technically Faithful!

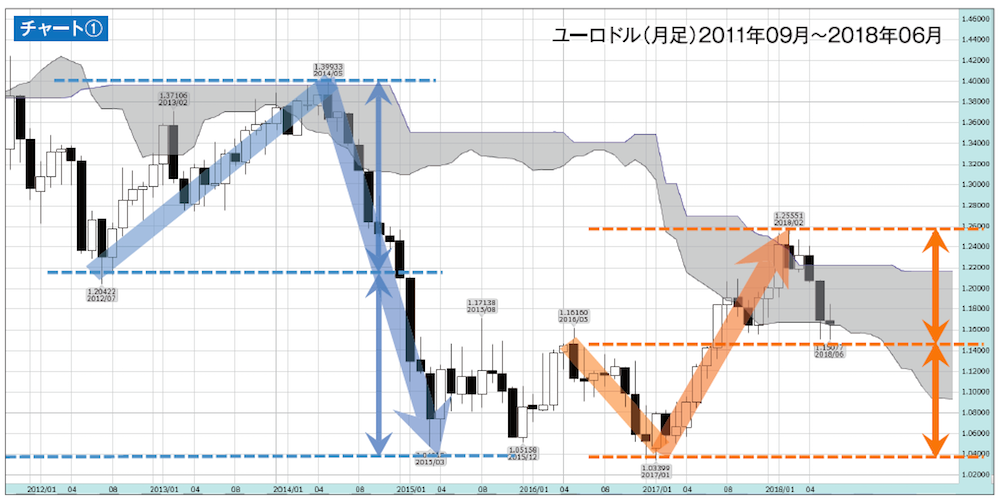

In the previous update of this column, I stated targets for the EUR/USD at the near-term downside, such as “the November last year low of 1.1554” or “the 50% retracement of the rise from the January last year low to the recent February high, around 1.1448.”

In other words, the sharp decline in EUR/USD that began around mid-April continued into the last piece (late May), and the view was that “around the 1.1500 level, it would not be surprising if it stops falling and rebounds.” As expected, EUR/USD fell to as low as 1.1509 on May 29, then stopped the decline and rebounded, and by mid-June had recovered to around 1.1850.

As I have repeatedly noted in this column, EUR/USD is the currency pair with the largest trading volume in the market, so its moves can be said to be extremely faithful to technical analysis (predictions based on analytical techniques).

Looking back a bit, the high on February 16 this year of 1.2555 dollars was positioned near a long-term resistance line formed by connecting the July 2008 high and the May 2014 high, which is one reason the upside was capped at that line. Moreover, that high is close to the 38.2% retracement of the decline from the July 2008 high to the January 2017 low, indicating that several milestones converged there, and the price rose to that level before turning down.

As can be seen in Chart ①, the February high exceeded the upper boundary of the monthly Ichimoku Cloud slightly, suggesting that the upper limit of the monthly Cloud was a key near-term resistance. Indeed, when EUR/USD briefly rose to 1.3993 in May 2014, the upper edge of the monthly Cloud ultimately capped the upside and led to a subsequent decline.

Furthermore, the February high this year corresponds to roughly double the decline from the May 2016 high to the January 2017 low, i.e., it is the ascent taken from the January 2017 low, which is a characteristic of a “full retracement that’s doubled.” A similar pattern can be seen in the Euro-Dollar pair during the rise from the May 2014 high to the March 2015 low, where the move also reflected a “full retracement doubled.”