Is averaging down guilty? I was taught by Kawasaki Dollaremon-san about strategic averaging down

Mr. Doruemon Kawasaki, the developer of Guruguru Train, reportedly uses averaging down when engaging in discretionary trading. Averaging down is generally said to be a bad move, but how does Kawasaki Doruemon master it? It becomes clear that “planned averaging down is not a bad move.”

What you can learn from this video

This video covers the following:

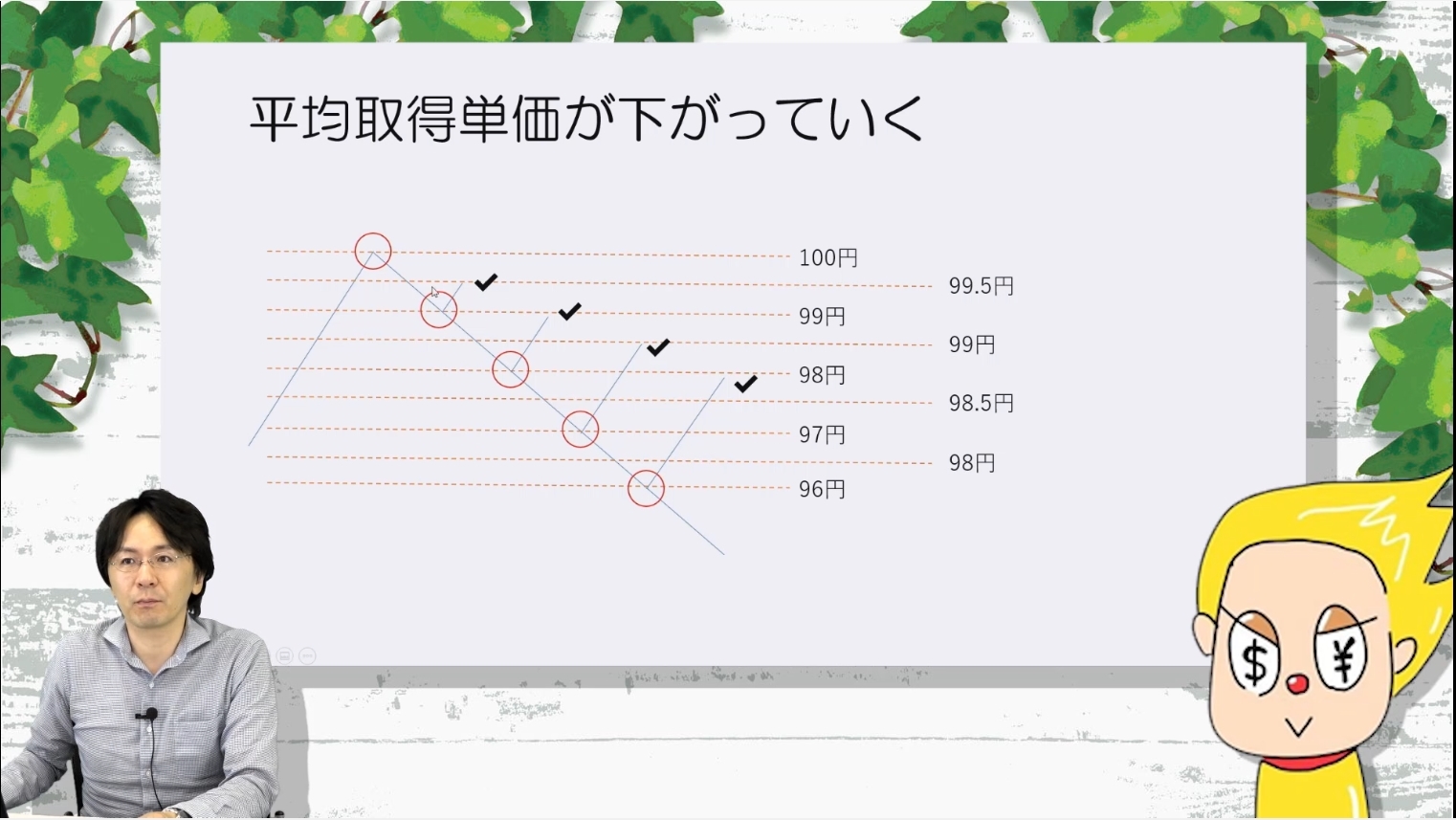

- Averaging down is, roughly speaking, a method to lower the average entry price

- Averaging down is difficult in one-way markets (for example, USD/JPY in a trend)

- Difference between trading 10,000 units and averaging down every 10 pips with 1,000 units

- Introducing a specific planned averaging-down strategy! A real example of a 5-pip counter-move averaging down

- Adaptable to currency pairs and market conditions

- How do you think about taking profits?

- Points to consider when implementing planned averaging down

● Video: 15 minutes 06 seconds

Kawasaki Doruemon Profile

Feeling limited by discretionary trading, he sought a system trading method that minimizes mental burden and makes profits with ease. After various simulations, Guruguru Train was completed.

Official site:Doruemon Kawasaki FX Blog

Twitter:https://twitter.com/kawasakidoruemo

How to view FX technique videos

The portion available to readers (at the bottom of this article) embeds FX technique videos. Click the play button to start the video.