Motty's FX Advice Column | Episode 1 Small Steps, Big Results

Kototsu-dokan is one of the typical patterns of traders who can't win! It’s when you steadily earn profits, but a single trade can blow them all away in one go. Beginners especially tend to do this, so let’s address it now ♡

※This article is a reprint and revision of a FX攻略.com October 2018 issue article. Please note that the market information written in the main text differs from current market conditions.

Real-life Failures — On the first pound-yen trade, all the steady profits from the dollar-yen were blown away…

This is around my second or third year of trading. My main trading style back then was scalping, glued to the chart. One day, I was happy to be up about 50,000 yen steadily in dollar-yen, got cocky, and traded pound-yen, which moves more than dollar-yen. I had some strange confidence, you know (lol).

Of course, back then I didn’t have solid justification or theory, and I kept scalping, but I ended up blowing all my profits in pound-yen w.

Looking back, I think it was a painful but valuable experience. If I can reflect on the big mistake and apply it to the next time, that mistake becomes a part of success.

Editorial Desk: I trade scalping, but I still win little by little and get blown up in one go (cry). What should I do?

MotteyI used to have profits blown away by Kototsu-dokan as well. There must be a cause for everything! First, think about the causes of kototsu-dokan, and consider solutions ♡

Editorial Desk: Indeed! What could the causes be? Maybe because I’m greedy…

MotteyGreed might be one of them (laughs)

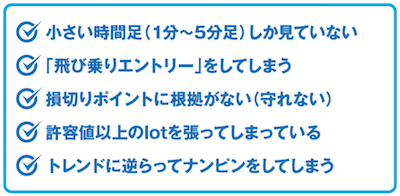

The Cause of Kototsu-dokan is clearly!!

Did any of the above apply to you?

There are other causes too, but one of the major ones is "how you read the chart." Do kototsu-dokan traders tend to look mostly at 1-minute and 5-minute charts?

What constructs the chart (especially the trend) is the higher timeframes. Therefore, you must look at the 1-hour and 4-hour charts, and even the daily chart, from a broad perspective; otherwise, you can go against the big trend and have your position swing against you dramatically…