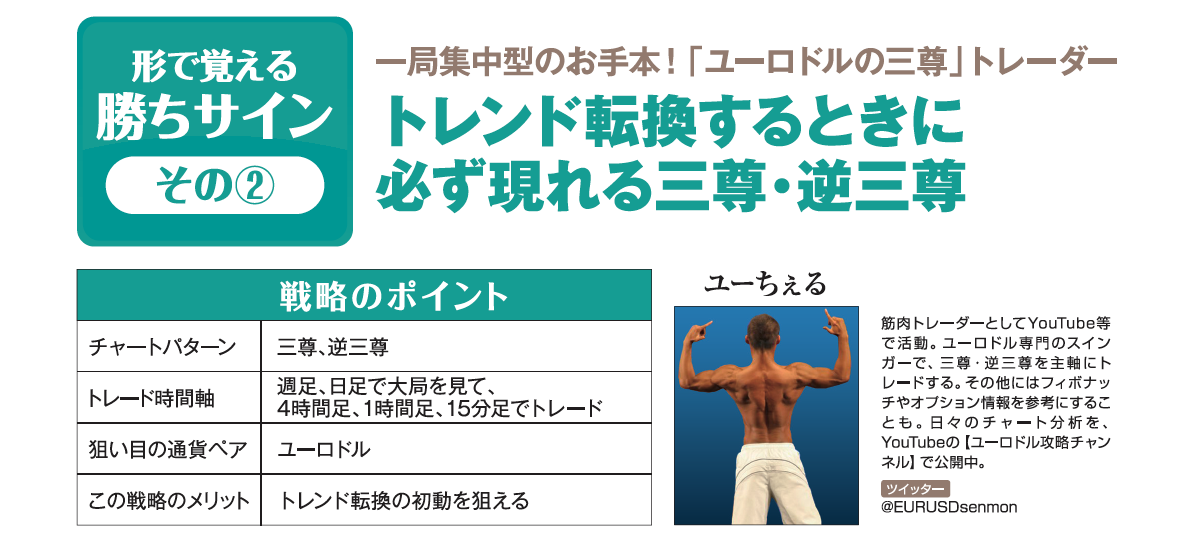

[Sign of Victory You Remember with Shape] A one-game focused exemplar! “Head and Shoulders” of EUR/USD Trader A classic pattern that always appears at trend reversals: head and shoulders and inverse head and shoulders [Yu-chel]

Yu-chel-san Profile

As a muscle trader, active on YouTube and other platforms. A euro-dollar specialist swinger, trading mainly on the head-and-shoulders and inverse head-and-shoulders patterns. Also references Fibonacci and options information. Daily chart analysis is published on YouTube's "Euro-Dollar Strategy Channel."

Twitter:https://twitter.com/eurusdsenmon

※This article is a reprint/edit of an article from FX攻略.com October 2019 issue. Please note that the market information written in the main text may differ from the current market.

※The "Strategy Points" and the main text assume a long position in a rising market. In a falling market, the rules are the opposite for short positions.

Strategy Points

- Chart patterns: head-and-shoulders, inverse head-and-shoulders

- Trading timeframes: view the big picture on weekly and daily charts, trade on 4-hour, 1-hour, and 15-minute charts

- Target currency pair: Euro-Dollar

- This strategy's advantage: catches the initial move of a trend reversal

Aim for the initial move of the trend generated from head-and-shoulders/ inverse head-and-shoulders

New

- If the move clears the neckline at the level of the retracement high (the start of the second valley), shift focus to an uptrend

- In the process of forming the third valley, gradually buy

Settlement

- Take profits when the price range from the bottom to the neckline is measured above the neckline

- Place a stop-loss a little below the bottom

× ![]()