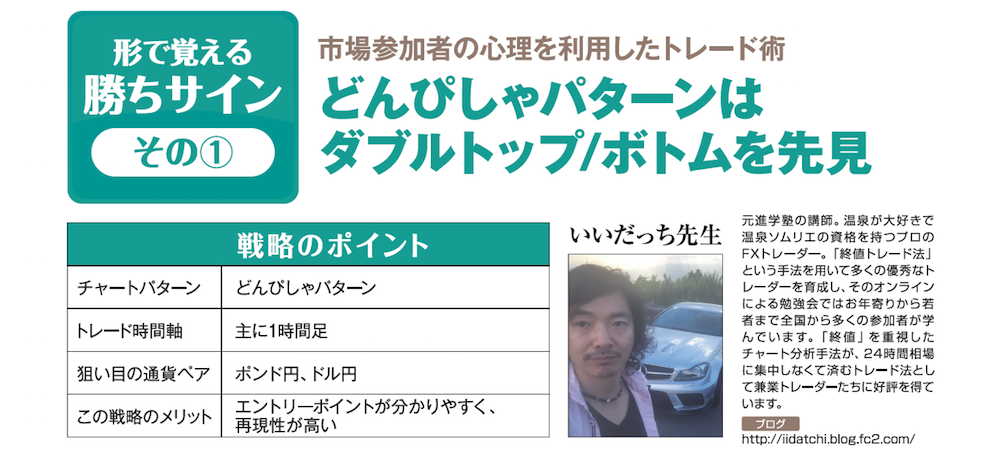

【Remember with shape the winning sign】Trading techniques that use market participants' psychology. The perfect pattern foresees a double top/double bottom in advance [Goodatchi-sensei]

Idatchi-sensei's Profile

Former instructor at a preparatory school. Loves hot springs and holds a spa sommelier qualification, and is a professional FX trader. Using the method called "End-of-Candle Trade Method," he has trained many excellent traders, and in his online study sessions, participants from all over the country—from the elderly to the younger generation—learn together. The chart analysis method that emphasizes the "closing price" is popular among part-time traders as a trading approach that does not require concentrating on 24-hour markets.

Blog:http://iidatchi.blog.fc2.com/

※This article is a reprint/edit of an article from FX攻略.com October 2019 issue. Please note that the market information written in the main text differs from the current market.

※The "Strategy Points" and the main text are explained assuming a rising market for long positions. In a falling market for shorts, the rules are opposite.

Strategy Points

- Chart pattern: Donpisha pattern

- Trading time frame: Mainly 1-hour chart

- Pairs to target: GBP/JPY, USD/JPY

- Benefits of this strategy: Entry points are easy to understand and highly reproducible

Simple Logic That Uses the Psychology of "Wanting to Buy Cheap"

New

- Check whether price is approaching a recent low

- When the close price is almost the same as the recent low, enter a buy

Settlement

- Take profits based on the average daily range or the Idatchi line

- If it does not reverse and closes below the low, cut losses