Naniwa's Chart Doctor: Masao Kamito's Intermediate Wave Method for Mastery! [Masao Kamito]

Many people are highly interested in trend markets where profits can be large, but there may be others who show no interest in situations without a trend. To capture profits completely in a trending market, you must master the phases where a trend has not yet emerged, known as the intermediate wave. Here, Mr. Shindo will teach us how to master such intermediate waves.

*This article is a reprint and edit of an article from FX攻略.com October 2019 issue. Please note that the market information described in the text differs from the current market.

*In this series, the term “intermediate wave” is unrelated to the intermediate wave in the Ichimoku Kinko Hyo system.

Masao Shindo Profile

Shindo Masao. Under Kojiro Tezuka, the representative of Tezuka Koji Office Co., Ltd., he works as a strategist and technical analyst. He posts various chart analysis ideas on TradingView.

Twitter:https://twitter.com/masao_shindo

A Popular Idea Poster Explains His Method

Hello everyone. I am Masao Shindo, posting ideas on TradingView. Thanks to everyone’s support, I ranked No. 1 in the idea posting ranking (overall). With gratitude, I will openly share the methods I am proficient in without holding back.

What is an Intermediate Wave?

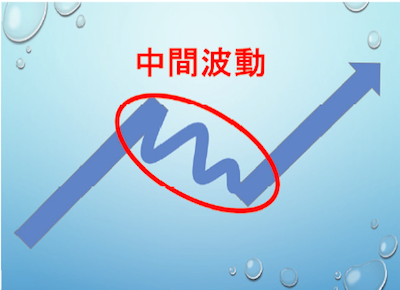

I have always believed that whoever masters the intermediate wave (the correction phase) controls the trend market.

An easy-to-understand rising market is an uptrend, and the opposite is a downtrend. If the trend were straightforward and moved between a major bottom and a major top in a one-way street, anyone could make a fortune. However, in reality after a clear trend, prices show complex movements for a while, shaking out traders, and then, as if nothing happened, the trend returns to its path and continues. The phase where traders get whipped around between trends is called the intermediate wave. One pattern that emerges in the intermediate wave is the triangle.