Nanaka Nonaka aims to become a full-fledged trader! Learn FX with Nanamin - Episode 5

Nanami Nonaka, a FX actress, joins forces with FX specialist Yasushi Yamanaka to learn together what is necessary to profit in FX in order to improve trading results. In this installment, he will teach the basics of fundamental analysis.

※This article is a reproduction and editing of an article from FX Strategy's October 2019 issue. Please note that the market information written in the main text differs from the current market.

Click here for the list of serialized articles

【Table of Contents】Aim to become a confident trader with Nanamin! Learn FX with Nanamin

Yasushi Yamanaka profile

Yamanaka Yasushi. Joined American Bank in 1982, became Vice President in 1989, Proprietary Manager in 1993. Joined Nikko Securities in 1997, Deputy Head of FX Funds at Nikko City Trust Bank in 1999. Established Ascendant Co. and became Director in 2002.

Official blog:Ascendant/Yamanaka Yasushi's FX information distribution site

Twitter:https://twitter.com/yasujiy

Nanami Nonaka profile

Nanami Nonaka. Born March 17, 1997. From Fukuoka Prefecture. Works in films, stage, and commercials, while also hosting a regular program on Radio Nikkei; active as an FX actress. Updates her daily trading on her blog.

Official blog:FX Actress Arrives! Serious Real-Time Trading Diary of a Rising Actress Nanamin

Twitter:https://twitter.com/himnas03

The relationship between bonds and stocks

NanakaIn this series, I’m learning the basics of FX from Mr. Yamanaka. This time’s theme is “the peripheral markets such as the stock market and commodity markets.” Thank you, Mr. Yamanaka.

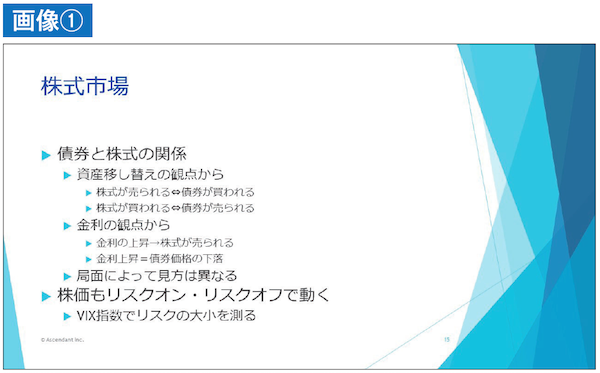

YamanakaFirst, about the stock market (Image ①). The stock market is familiar because various stocks are bought and sold on securities exchanges. Among stock prices, major indices that are highly liquid and have large market caps, such as the Nikkei Average, the Dow Jones, and Germany’s DAX, are important. In stock or bond investments, you often hear the words portfolio and diversification.

NanakaIf you invest all your assets only in stocks, you may incur large losses when stock prices crash, so you protect your assets by diversifying into various financial instruments.

YamanakaThat’s right. There’s the saying, “Don’t put all your eggs in one basket.” In short, don’t concentrate investments in one place.

For example, you could invest half in domestic products and half in overseas products, with domestic products split half in stocks and half in government bonds, and do the same for overseas products. This is classic diversification. From the perspective of reallocating assets with this classic diversification, when stock prices seem likely to rise, investors will want to reduce bonds and increase stocks. Conversely, when stock prices seem likely to fall, investors will reduce stocks and increase bonds. Therefore, when stocks are sold, bonds are bought; when stocks are bought, bonds are sold, reflecting a correlation.

Another commonly discussed topic recently is the idea that “when interest rates rise, stocks are sold.” There are stock dividends that come in 1–2 times a year, do you know what they are?

NanakaDividends, right.

YamanakaExactly. Stocks have dividend yields calculated, and if the stock price doesn’t change, you receive a dividend equivalent to the interest rate over a year. In both Japan and the US, stock dividend yields are roughly in the high 1% to about 2% range. When comparing Japanese stocks to government bonds, government bonds yield virtually zero, while stocks include about 2% of an interest-like portion.

Therefore, regardless of the price movement of the stock itself, if government bond yields fall, there is a move to buy stocks to gain the dividend yield; conversely, when bond yields rise, stocks tend to be sold. This reflects investor psychology about which investment is ultimately more profitable.

Next, from the interest-rate viewpoint, when government bond yields fall, bond prices rise.

NanakaBecause prices adjust in response to the drop in rates.

YamanakaThe government issues a large amount of bonds which the Bank of Japan purchases. When the BOJ buys government bonds, bond prices rise, but the corresponding yields fall. Hence, by buying bonds in large quantities, the BOJ tends to prevent yields from rising. Conversely, in a rising rate environment, bond prices fall. Then, in a rising-rate scenario, bonds fall and stocks may also be sold when compared with the rising rates. Earlier, I explained that when stocks are sold, bonds are bought, but from the interest-rate perspective, when stocks are sold, bonds also fall. Have you heard of the term “triple bottom” in this context?

NanakaIt means a broad decline across major markets such as stocks, bonds, and currencies in a country.

YamanakaFor example, in the United States, US Treasuries are sold, US stocks are sold, and even the dollar itself is sold. In Japan’s Triple Bottom, stock prices fall, Japanese government bonds are sold, and the yen weakens.

This is the most dreaded situation: essentially a decline in national power and rising market uncertainty, leading to selling. In normal times, it’s simply asset reallocation. However, when markets become abnormal and risk-off movements spread widely in that country, both stocks and government bonds are sold. If currencies are also sold, you get a triple bottom scenario.

In that sense, the stock market is closely connected to the interest-rate market, particularly long-term rates and bonds. By looking at the relationship between stock prices and interest rates, you can gauge risk-on or risk-off trends.